- Stash vs Robinhood – Which is Best? - June 26, 2020

- Robinhood vs Fidelity Comparison - June 13, 2020

- Firstrade vs Robinhood: Which Option is The Best? - April 10, 2020

Day to day “adulting” is hard enough without the stress of a tight budget and planning for retirement. For the majority of us, financial stability and gain can simply be over our heads. We know that we have to maintain an income to pay our bills, but beyond that, it can get difficult to allocate our money in all the wise places.

Luckily, two apps will help you organize your finances and even automatically alert you when something goes arie. Personal Capital and Mint are financial apps that will whip your bank account into shape and keep you informed when you need to work on your credit score, invest more, and alert you when funds are getting low.

Main Differences Between Personal Capital vs Mint

The main differences between Personal Capital vs Mint are:

- Personal Capital offers a free and paid version, whereas Mint is free.

- Personal Capital has customer support that works 24/7, whereas Mint has customer support from 5 am to 9 pm PCT.

- Personal Capital requires authentication with a unique PIN, whereas Mint requires multi-step verification.

What is Personal Capital?

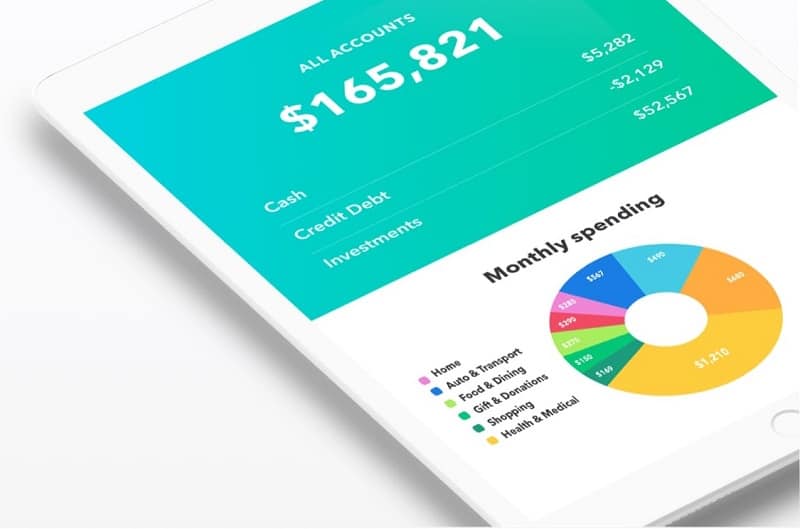

Personal Capital is a free online and mobile app that helps you make informed decisions regarding personal finances and investments.

Personal Capital’s target market is those looking for a free investment management tool. It will also keep track of your spending by aggregating your banking accounts and credit cards all in one place.

The financial app is free; however, they do see advanced investment advisory services to a small group of their users. This is great for both users who are searching for help with their investments and those who want to take advantage of the free app. Since Personal Capital makes money from users who can afford an advisory fee, you won’t see a lot of upselling or ads constantly trying to get you to buy services from them.

To use the free service, you will need to link any financial accounts that you would like analysis of. Those accounts may include checking, 401K, etc. You will need to know your log-ins for these particular accounts so you can link them through the app.

History of Personal Capital

Personal Capital was created in 2009 by Bill Harris, Rob Foregger, Louie Gasparini and Paul Bergholm. The financial app was originally named SafeCorp Financial Corp.

The name was changed to Personal Capital before publicly launching in 2011. It is registered with the SEC as an investment advisor.

Personal Capital currently has over 2 million registered users taking advantage of its free app.

Users of the app must have investments that total $100,000 or more to be eligible for paid financial advisor services.

What is Mint?

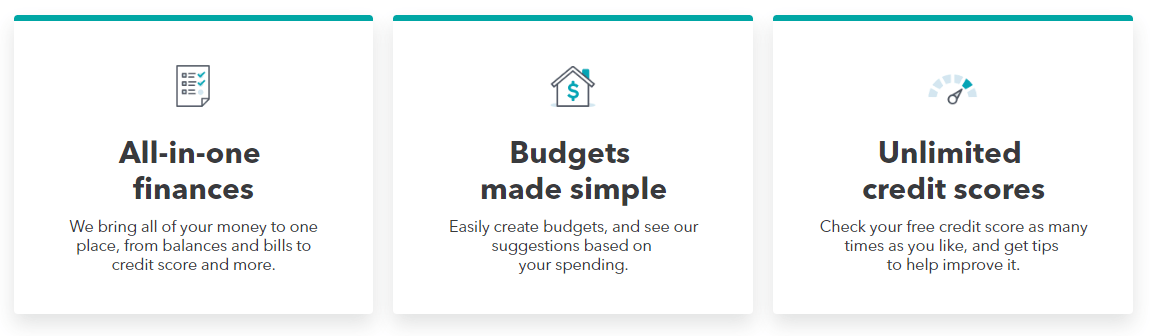

Mint is a free financial tool that aggregates all of your linked financial accounts for individualized money tracking.

You can easily create a financial profile with an email address and password. Entering your profile information such as location, age, education, income, etc. will add you to Mint’s database.

You might be hesitant to give over this information, but adding your profile to the database will give you insight on your spending habits. Do you spend more than the average 30-year-old in your city? The app can quickly tell you where the majority of your money is going each month. Spend all your money on restaurant food? Mint will recommend the best restaurant rewards credit card so you will feel a little less guilty about not cooking dinner at home.

The more diverse accounts you link, the more product recommendation Mint will make. Mint can offer you sound advice on bank accounts, credit cards, investment firms, and more.

History of Mint

Mint was created by Intuit. Intuit was founded in 1983 and is most famous for providing consumers and businesses with Quickbooks and TurboTax.

The Mint app is backed by over 20 million users.

Personal Capital vs. Mint Features

The following features are benefits that both apps, Personal Capital and Mint, provide for free to their users.

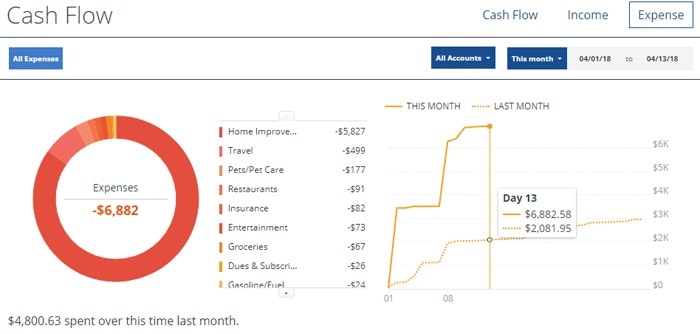

- Spending and Savings. Both apps can aggregate your income coming in with your bills and everyday spending. This is very helpful if you are constantly overspending and need to know where the money is falling through the cracks. It can also help you save money for larger goals by helping you see where you could save money and even negotiate monthly bills such as TV, Internet, and cell phone charges.

- Net Worth. Quickly see your net worth rise as you pay down debt. This charting can be a great motivator to improve your financial situation.

- Budget. Use the app to set a budget for different spending categories or an overall monthly budget, so you have money left at the end of the month.

- Progress Reports. Need to know your financial situation like right now? Both apps provide you will financial reporting in real-time so you can make informed financial decisions 24/7.

- Investment tracking. Personal Capital and Mint can track your investments from several financial institutions and make recommendations based on defined parameters.

- Multi-factor authentication. Are you worried about linking all of your financial information in a third-party app? Both Personal Capital and Mint have multi-factor authentication, so your information if for your eyes only.

- Zillow Integration. If you own your home, you should be concerned about its worth. Although most real estate goes up, that is not always the case. Whether your home is a long-term investment or you are moving soon, Personal Capital and Mint can give you daily updates on your home’s value based on Zillow’s calculations.

The Main Differences Between Personal Capital and Mint

Personal Capital

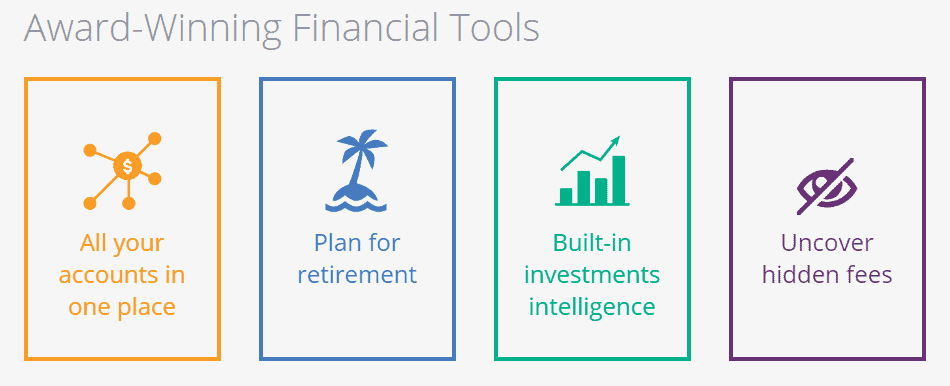

- Diversified Portfolio. Personal Capital can take investments from several different portfolios and companies and put them together so you can see how much money you have where. It will also show you the current values and which investments are doing better than others. High-quality charting and analysis pages look professional and are easy to comprehend.

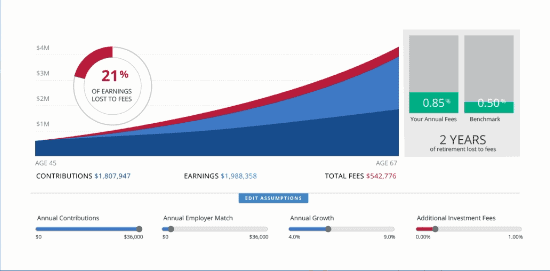

- Fee Analysis. Instantly see what admin fees you are paying for stocks, bonds, etc. The app will even show you hidden fees that you didn’t even realize were affecting your retirement nest egg. This is great for knowing if your investment company(s) are competitive in their fees or if you should consider switching to save.

- Tax optimization. Investing your money also comes with perks in the form of credits or deductions to reduce your yearly taxes.

- Personal Capital uses three areas to help you get the most out of your money:

- Tax allocation. (high-yield investments in tax-deferred or exempt and low-yield in taxable)

- Tax-loss harvesting. Sell off losing investments to pay less tax and increase your long-term gains potentially.

- Tax efficiency. Investing in a diverse portfolio can create different tax costs, Personal Capital will help you choose the best investments for tax savings.

Personal Capital also provides retirement planning, estate planning, home purchasing, refinancing, and college savings for free within the app.

See how Personal Capital compares to others:

Mint

- Credit score monitoring. You can view your credit score in Mint by clicking on the “Credit Score” tab on the dashboard. This is critical information to view before applying for a loan. Mint will also give you advice on how to increase your credit score if you would like to improve.

- Credit score monitoring is powered by TransUnion. The following factors can affect your credit score rating:

- On-time payments. If you miss a bill payment, your credit score can go down a whopping 100 points!

- Credit utilization. You should be using around 30% or below of your credit limits. For example, if you have a credit card with a $12,000 limit, you should only have a balance of less than $3,600.

- Length of credit. The longer you have been building your credit, the better. Good credit for a longer period shows consistency.

- The number of accounts. While you should focus on active accounts that you can make monthly payments on, credit scores can reflect higher when you have multiple open accounts.

- Credit inquiries. Try to limit the number of hard inquiries you do at one time. For example, buying a house, a car, and acquiring a personal loan all at the same time can temporarily lower your credit score.

- Derogatory remarks. Have you filed for bankruptcy or chose not to pay a loan back? These marks can lower your credit score and take time to repair. Derogatory remarks should be a last resort only.

To secure the lowest loan rates, your credit score should be above 700. TransUnion will notify you through the app when your credit score goes up or down.

- Bill-tracking. Tired of not paying your bills on time? Sometimes we are just too busy and forget a payment due date. You can set reminders in Mint so that your bills get paid on time, every time. Mint will even help you track bills that are set to auto-pay.

Mint has a large database of bills to quickly add to your account like Verizon, Chase, and Navient. If you have a monthly bill that is local or from a small business that is not listed, you can still manually enter the bill and track it.

- Low account balance tracking. Living paycheck to paycheck? We have all been there. Set up an alert on Mint when your bank account hits a base threshold, so you know to halt your spending.

- Unusual spending alerts. The longer you use Mint, the more the software gets to know you. If you normally spend $100 in gym fees every month and the gym just charged you double, Mint will alert you so you can take care of the double charge before it affects upcoming bills or causes you to overdraft.

- Smart tagging. Mint allows you to tag the purchases you make on a regularly. For example, tagging a gym membership under “health” can tie in your gym membership expenses with doctor’s visits and prescriptions. Once you tag a recurring transaction, it will always appear with the new tag. This makes it easy to segment your transactions and see which area of your lifestyle costs you most or costs you the least.

Ease of Use

Both Personal Capital and Mint are very easy to use even for people who do not consider themselves to be computer or tech-savvy. They both include user-friendly dashboards and practical charting. With easy to download apps, you can use the financial helpers at home or on the go.

Is Personal Capital Free?

The cost for the app is free, no matter how much you have in assets. Keep in mind that Personal Capital makes its money from higher-end users that invest over $100K, so if this is you, expect a sales pitch for advisory services.

If you need financial planning services, Personal Capital is a worthy choice. Their services are fee-only, which means you will pay a fee each year for financial planning based on your portfolio dollar amount but no hidden fees for commissions, etc.

Their current fees are 0.89 percent a year on $1 million of AOM (assets under management).

- 0.89 percent on the first $1 million

For investors who invest $1 million or more:

- 0.79 percent on the first $3 million

- 0.69 percent on the next $2 million

- 0.59 on the next $5 million

- 0.49 percent over $10 million

Is Mint Free?

The cost to use the app is free. Mint makes its money on referrals from its users signing up for financial institutions, recommended products or credit cards. Mint also has a “Ways to Save” service that offers its users personalized financial opportunities.

Security

Personal Capital has two-factor authentication and Verisign. This extra security step requires you to confirm your identity with a text message or phone call PIN every time you log-in from a new device.

Mint offers security scanning through Verisign for safe data transfer. Just like Personal Capital, Mint offers multi-factor authentication.

It is important to note that third-party financial apps (those that aggregate your financial information) can not cause any disturbances to your account. While a hacker could still potentially view your information, they cannot transfer or withdraw money since the transactions in these apps are read-only.

Blog

Both Personal Capital and Mint have content-rich blogs that are worth reading when you need help with finances. While the Personal Capital blog focuses on the stock market and investing, Mint focuses on saving and budgeting.

Personal Capital

Mint

Personal Capital

Pros

- Large investments

- Managed investments

- Tax optimization

- Free to use

- Two-factor authentication

- Easy to use on all devices (Desktop, Android, iOS)

Cons

- Optional financial service fees can be pricey

- Leans more investment tracking and less on day to day financial tracking

Mint

Pros

- Easy to use on all devices (Desktop, Android, iOS)

- Free to use

- Bill-tracking

- Goal setting

- Trends analyzer

- Credit score monitoring

- Cash flow trend analyzer

- Email alerts and reminders

Cons

- Syncing issues with some linked accounts

- Customer support needs improvement

- Bank accounts can only have one goal linked. Multiple goals from the same account are not supported.

- Biased financial product recommendations

FAQs About Personal Capital vs Mint

Personal Capital is better equipped to help you analyze and create a strategy, whereas Mint is a budgeting platform that offers little investment support.

Yes, it’s safe to conntect your Mint account to your bank account, and you can rest assured knowing that hackers can’t touch them, as neither they or you can make any movement and transfer money from either of these two accounts?

While it’s safe to give your information to banks and online banks, make sure you don’t overshare them, as this increases the risk of a data breach.

Conclusion

Both Personal Capital and Mint have their strengths. Personal Capital is to investments as Mint is to budgeting.

If you are fairly new to the financial arena and you need help allocating your monthly funds for food, shelter, and Amazon purchases, I would recommend starting with Mint.

The ability to tag your purchases, segment them into real-life categories, and to set a goal with a platform that can keep you accountable with reminders and alerts is worth your time.

Once you get more financial savvy and choose to allocate a percentage of your funds in the stock market or a 401K, you should consider using Personal Capital.

On the investing side, Personal Capital can help you take charge of your retirement and even be used as a free educational tool so you can bring up questions to your local financial advisor.

If you continue to amass wealth, Personal Capital can grow with you and provide you with the financial planning you need to provide long-lasting financial security.

Since both apps are free, I recommend taking advantage of both. The sign-up process only takes a few minutes, your information will remain secure, and financial growth can only happen if you put a little effort towards it.

While their strengths are diverse, their goals are the same. Secure your financial future with Personal Capital and Mint.

Recommended Reads

- Chime Bank Review: Is This a Good Alternative to Traditional Banking? In this Chime Bank Review, you will discover how this service works, its pros, cons, and other details you need to consider before you decide to opt for it.

- Capital One Savor Rewards Credit Card Review: Read our Capital One Savor Rewards credit card review we see its pros, cons, what it has to offer and some alternatives you can consider and compare it to.