- Personal Capital vs YNAB: Which Tool is Best? - July 5, 2020

- How to Invest 50K: Investment Ideas for 50,000 Dollars - April 26, 2020

- Fidelity vs Etrade: Which is the Perfect Online Brokerage Platform for You? - April 10, 2020

If you are looking to diversify your investments at this time and age, you are spoilt for choice. The internet has made it easy to invest in various assets using applications and web-based platforms. Online real estate investment apps have emerged as a popular way to get money passively.

Robinhood is a popular investment app that lets you pursue low-cost trading without paying for it. When the deal is too good, think twice. You probably think that the no-fee feature makes it look fishy. However, the reasoning behind this feature sheds some light on the whole matter. When you are investing, there is a degree of risk involved. Stock trading apps that charge no commission, such as Robinhood, restrict you from putting in more money than you should, thus reducing the amount of money that is exposed to risk.

No trading platform is perfect, and Robinhood is no different. It is one of the top trading apps for a reason, but it has a few demerits. On the other side, a suitable trading app depends on your investment goals, and while it might be ideal for some, others might find it different.

Worry not, as there are top alternatives to Robinhood for you to look at if you are displeased by what it offers. These platforms vary in what they offer, and if you take a closer look at the features they offer, you should land one that suits your investment goals.

An Overview of Robinhood

Robinhood is a top mobile trading app that made waves globally from the day it was launched. It is a free stock trading mobile app that offers a free, concise, and easy to use platform for investors.

It is suitable for beginners seeking to trade for the first time owing to how its user interface is simple and offers multiple integrations with deposits, among others. While it lacks the full-service trading platform and desktop other brokers have, it is easy to understand and aesthetically friendly to users.

It has both free and paid options. The paid option, Robinhood Gold, offers pre and post-marketing trading and gives you the option of trading on margin in exchange for a maintenance fee. The paid account works with a minimum of $2000.

Why Consider Robinhood Alternatives

You should look at the Robinhood alternatives if your expectations do not match with what Robinhood offers. Here are some of the features;

Analytic Features

Top trading platforms want their investors to make as much money as they can. This way, they offer them a plethora of trading resources and tools that guide them to make better investment decisions.

Robinhood is a concise platform that lacks extensive analytic tools. You can create watchlists and view real-time market performance, but this is just about it. Robinhood targets young investors who want to learn more before investing, and if you feel that the analysis bit of it is significant, you have a reason to look at the alternatives.

Candlestick Options

Robinhood is keen on creating a simple interface for investors. However, its candlestick charts are hard to view on mobile. It uses the standard green and red candle scheme, but shadows are hard to see on the white background. You cannot tweak the candle periods to hours or minutes as it is on other platforms.

Tax Savvy Accounts

If you want to save for retirement or open an IRA, Robinhood is not the platform for you. It offers only individual taxable accounts.

Essential Features To Look For In A Robinhood Alternative

If you have already used Robinhood and want to find an alternative, it is only logical that you find something better than what you have. Robinhood is a remarkable trading app, and it sets the bar quite high for these alternatives. Here are some top features to watch out for;

Trading Fees

It is impossible to beat Robinhood in this aspect since it charges nothing for trades. However, you should look for trading apps that let you trade for a low amount. You will find many that charge less than $7 a trade. Some of them let you invest in mutual funds or index funds with no commission.

Simplicity

A brokerage app will be of no good to you unless you understand how to use it. Before you settle on a specific one, find out how to use it on YouTube and by reading through the reviews about it on the internet. Make sure that the user interface will make it comfortable to trade. The top apps do not limit trading to mobile apps only as they also offer a web platform for those who prefer it.

Tax Compliance

Tax is a huge concern if you are investing. If you are a serious investor looking to buy stocks for a long time, you might be better off reducing your tax obligations by opening an IRA. Robinhood does not allow you to open such an account, but most of the other platforms do. This will help to reduce your tax liability.

The Best Robinhood Alternatives

Ally Invest

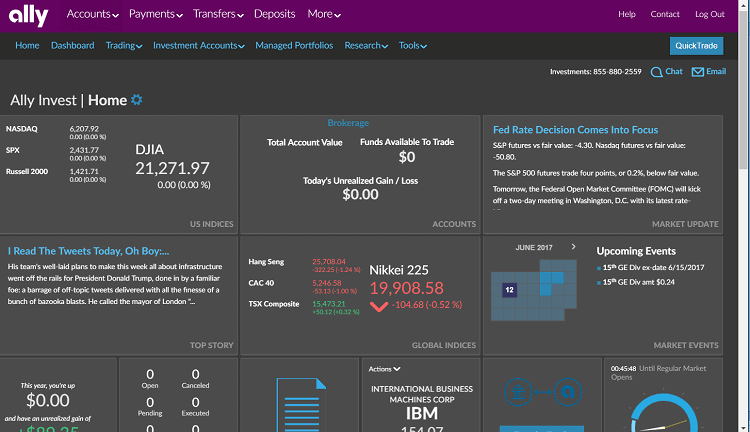

Ally Invest is a reliable online brokerage platform known for its comprehensive portfolio of products, low-cost options, and the ability to serve both novice and experienced traders. On opening it, you can be mistaken that the app suits beginners due to the font, purple letters, and simple infographics.

Well, its features stretch beyond what you see, and if you are a seasoned investor, do not be ward off by this aesthetics. The app is self-directed, making it appealing to advanced investors.

Other useful features are the advanced charting tools, market and company snapshots, watch lists, various calculators, and research tools to help them find out more about the markets. Other products offered include;

- Forex

- Futures

- ETFs

- Options and Binary Return Derivatives

- Mutual Funds

- Fixed Income

Ally charges competitive prices for trades, and they depend on the specific ones you are involved in and your volumes. The standard pricing is $4.95 per trade, with the amount going down to $3.95 for more than thirty trades per quarter and for those with balances that are over $100,000.

Ally Invest LIVE is the platform you can use to manage investments, and it is available to anyone who opens an account. This is a plus since other platforms require a minimum account balance for users to access their platform. It is user-friendly and has a dashboard, trading account, managed portfolio, and real-time streaming. You can customize the dashboard to fit your individual preferences.

Benefits of Ally

- Volume discounts for traders

- Charges low fees compared to other platforms

- Suitable for both beginners and experienced traders

- Good customer service

Downsides of Ally

- No physical location

Bottomline

Both Ally and Robinhood are designed with young investors in mind. Ally is more of a traditional brokerage platform, and Robinhood is a disruptive platform with a new strategy in mind. However, Ally has superiority in most of the useful features for investors except for the price, which is a critical factor when choosing a brokerage.

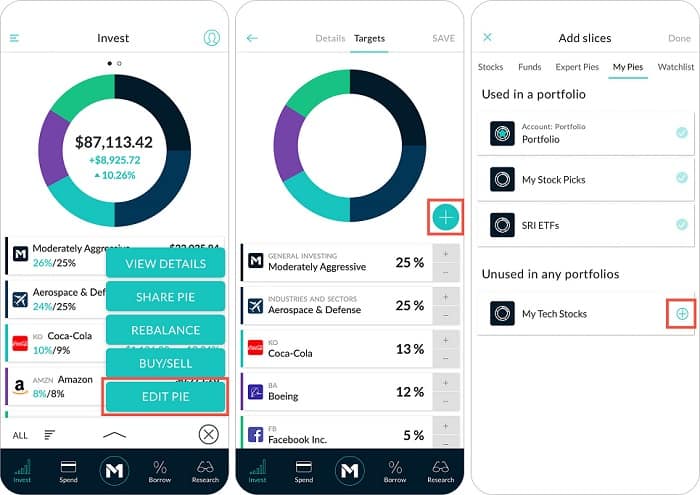

M1 Finance

This is an automated investing services that has a hybrid platform that borrows features from a traditional investment management service and a Robo-advisor. The main difference between other Robo-advisors and M1 finance is that they do not take your money and dictate where it will be spent. They give you control over your investment, and you determine where your money goes using a unique pe chart system.

When you open an account with M1 finance, you are required to answer a couple of questions regarding your savings goals and financial situation. From this information, the system will generate a suggested pie containing various assets that you can use to diversify your investment portfolio. You can include stocks that trade on the New York Stock Exchange or NASDAQ to the pie.

There are no fees associated with M1 Invest. They offer two services called M1 Borrow and M1 Spend, which have some costs. However, the free version of the account provides one trading window per day.

If you need to make more trades, you have to sign up for the M1 finance plus. This is because this tool is regarded as a long-term investing platform and not a regular trading platform. It offers retirement accounts and a feature called rollover concierge that allows you to roll over an existing 401k or IRA to your account.

Benefits of M1 Finance

- No fees charged on trades

- Easy to build a diverse investment portfolio

- Suitable for all types of traders

- Allows investing in fractional shares

- Has a referral program

Downsides of M1 Finance

- Restriction on trades makes it unsuitable for day traders

Verdict

Both Robinhood and M1 Finance offer commission-free stock trading. However, there are significant differences between the two as Robinhood provides an ideal platform for beginners, while M1 Finance is suited for long term investors.

M1 Finance has a minimum balance of $100 for a regular account and $500 for retirement accounts. M1 Finance offers comprehensive guidance in the form of expert pies and does not charge anything for people who wish to invest in these portfolios. Check out our full review take on M1 Finance here.

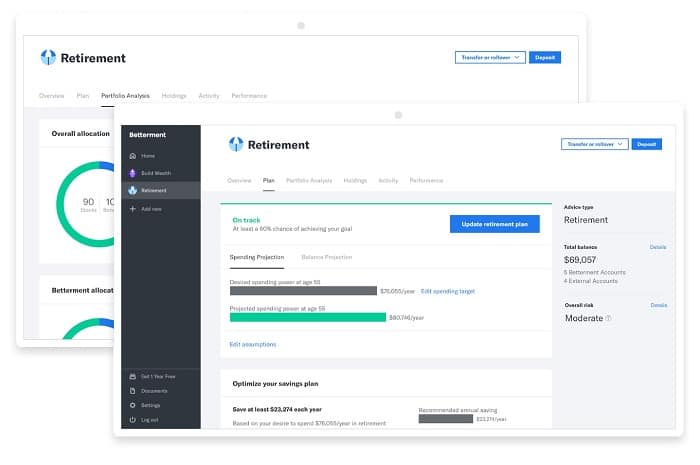

Betterment

Betterment is an investment platform, but its features make it more of a Robo-advisor. It is a top Robo-advisor since it has a $0 minimum balance and a competitive management fee of 0.25% of the portfolio for the basic service and 0.40% for the premium one.

The basic plan helps clients invest in cheap, globally diversified portfolios, provides automated rebalancing and advanced tax-saving strategies. It is a good pick for beginners and retirees who are seeking a tax-efficient platform to invest in.

Betterment offers a couple of research tools such as technical specifications and whitepapers that contain content needed by investors when making critical decisions. In case you sign up and find it hard to go about the platform, you can contact the customer support team, which is available seven days a week to respond to queries.

The team offers a free 15-minute call on sign up to help you get acquainted with the tool and get started. You can contact a group of licensed financial experts who are ready to respond to questions about investments and savings, among others.

Betterment is an excellent choice for millennials owing to the zero-minimum balance, automatic rebalancing, and low management fees. It takes the burden of micromanaging an investment portfolio off passive investors.

It uses a goal-based approach that lets you create a unique portfolio from 12 ETF classes. The goal-setting process is done when you set up the account, and this will help you set your savings objectives.

Benefits of Betterment

- Good customer support

- Automated rebalancing

- Has tax accounts

Downsides of Betterment

- The automation feature makes it bad for active investors who seek to have more control over their portfolio

Verdict

Robinhood and Betterment are all strong on their features, and it is hard to separate the two. However, it all goes down to your preferences, and if you want to control your portfolio, go for Robinhood.

Still, if you’re going to invest passively, Betterment can put your portfolio on autopilot. Betterment has an advantage with the provision of tax accounts, but overall, these are two distinct platforms that suit different sets of investors.

Acorns

This platform offers something new swing in the online trading platforms niche in that it provides more than just investments. It is an all-round personal finance and investment app. For the other platforms, all you need to do is deposit the money and start trading. For Acorns, you can start managing your finances better and build your investment capital and then invest it.

It connects with your debit and credit card and rounds your transactions to the nearest dollar. The savings are automated, and for anyone who finds it hard to save up the money needed to invest,

Acorns is their best option. For instance, if you buy something for $5.67 and use a card linked to the account, the platform will round off the amount to $6.00 and deposit the extra $0.33 into your investment account.

For the investment part, it offers five distinct portfolios depending on your needs and age. You will answer a few questions when signing up, and the platform will use this information to determine the best portfolio for you.

In a nutshell, it combines personal finance and Robo-advisor features in one platform. As a bonus, Acorns has signed an agreement with top retailers such as Nike and Disney, and if you pay for a purchase with an account linked card, you will get some money deposited into your account.

Benefits of Acorns

- It is a personal finance and Robo advisor platform

- It is suitable for investors who have no capital to start with

- Invests your money automatically in the selected portfolios

Downsides of Acorns

- The automated investments make it unsuitable for active and seasoned investors

Verdict

Acorns is the ultimate platform for beginners and people who think that they cannot start investing small. It offers you a choice of five portfolios to invest in. If Acorns is investing 101, Robinhood is probably 201. Robinhood provides a relatively advanced experience compared to Acorns.

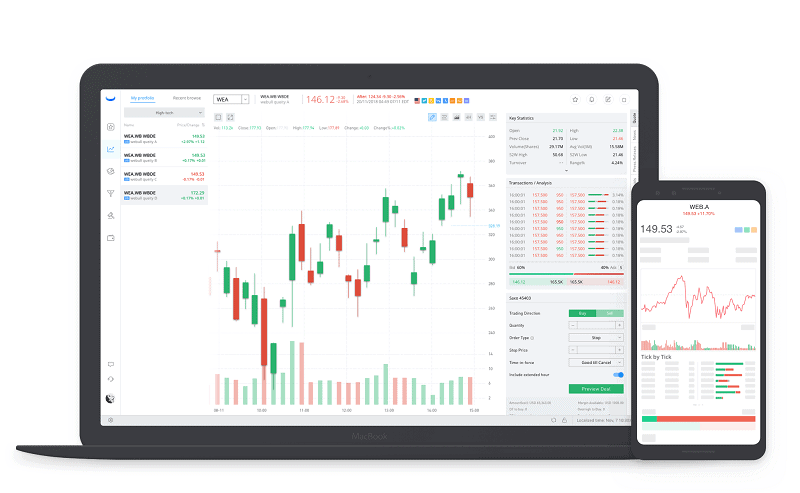

Webull

This is the go-to app for stock trading, although many people used Robinhood in the past. It has emerged as the better option for traders owing to its collection of features such as advanced charting, IPO center, and extended hours trading that let you invest before the markets open.

Webull app is impressive due to the information and features it has. You get everything needed to stay ahead of the market news, including stocks that are doing an IPO soon. The additional hours you get come both before and after the regular trading allowing you to trade on news that hit before other traders can come in.

One standout feature of this app is ‘paper trading’ which is a simulator that gives you $1 million to invest virtually. Here you can test out your investment strategies and get to terms with the platform before depositing some actual money into the account. Webull does not charge anything for trading.

When you open an account, you will get a free share of stock, but unlike Robinhood, which caps your free share at $200, you can get shares for up to $1000 on Webull. This app is suited for people who want to invest for the short term or want to try out new investment strategies.

Benefits of Webull

- Optimized for stock trading

- Additional hours for trading

- Higher cap on free shares

- Advanced trading features make it suitable for investors

Downsides of Webull

- You cannot trade cryptocurrencies

Bottomline

Robinhood and Webull are top options for investors looking to invest in stocks. They are free and have no minimum account balance. Webull can take longer for one to pack due to the technical charting options, and this makes it suitable for the experienced trader.

FAQs

With the rise of cybersecurity threats and online frauds, these investment platforms have taken measures to protect your money, and you should not worry about linking your cards. They use top security software to safeguard clients from online threats.

Investment strategies vary, and it all goes down to your needs. If you are a busy person who wants to trade and get some passive income, you will find a suitable platform for you. If you are a full-fledged day trader who invests for a living, there are platforms for you.

This is why it is imperative to choose between an automated investment platform and one that let’s take you a hands-on approach to your investment depending on how much time you have.

There is no established way of making huge returns in a short time with online trading. You should be patient and learn more about the assets you are trading in. A careful approach backed by facts will earn you significant returns over the long run.

Do not be mistaken, there is no golden rule to trading and take time to come up with a strategy that will help you achieve your investment goals.

Bottom Line

You are spoilt for choice if you are looking for a good Robinhood alternative. People are turning to these online platforms for easier management of their investments, and the beauty is that you can always get one that meets your requirements.

As seen from the listed alternatives, the platforms are optimized for different types of investors. When choosing one, take your time and analyze the pros and cons of a particular one to ensure that it fits your billing. With a proper investment strategy and a reliable platform, you should be able to invest comfortably and reap your rewards.

Further Research

- M1 Finance and Betterment: A Complete Comparison: Here, we compare M1 Finance and Betterment Robo-investment options. Check out their main difference, pros, cons and what each of them has to offer.

- Webull vs Robinhood Compared: Which Digital-Only Brokerage is Better for You?: Two very popular brokerage choices are Webull vs Robinhood. We take a look at their features, similarities, differences, and which is the right one for you.

- Robinhood vs M1 Finance Comparison: Here, we compare M1 Finance vs Robinhood: Robo investing sites that cut the fees to a minimum. I weigh the pros, cons, features and give you a few alternatives