- Wells Fargo vs Bank of America: Which is the Better Bank? - November 9, 2019

- M1 Finance and Betterment: A Complete Comparison - November 4, 2019

- Personal Capital vs Wealthfront: Which Should You Go For? - October 20, 2019

If you’re looking to manage your investments, you’ve probably heard of the two popular investment platforms, Personal Capital and Wealthfront. But which one is right for you? The investment arena can be overwhelming. Personal Capital and Wealthfront are just two of the investment manager options available, and yet even deciding which out of the two is right for you can still be a challenge.

First, decide what you want: Tailored advice? Budgeting tools? Low account minimum? And go from there. Though these platforms seem similar, they cater to a very different customer. Knowing the scale of your investment will play a critical part in which investment manager you will go with.

Wealthfront is for the beginner or smaller investor, who’s looking for broad investment management at a low cost while Personal Capital offers traditional human management, alongside substantial budgeting and assistance. But this is far too sweeping for someone to base their decision on. Let’s take a more in-depth look at these two investment managers to help you decide the perfect fit.

Main Differences Between Personal Capital vs Wealthfront

The Main Differences Between Personal Capital vs Wealthfront

- Personal Capital has a traditional human approach to investment management, whereas Wealthfront is an automated investment service meaning it’s managed by platforms powered by algorithms.

- Personal Capital is a fee-based financial management platform that offers free comprehensive financial software for personal finance, whereas Wealthfront doesn’t offer personal finance software or budgeting tools.

- Personal Capital is more expensive option, whereas Wealthfront is cheaper and offers lower-cost investment products.

Wealthfront

This may immediately scare some of you off, who might prefer the more traditional human approach to investment management. But before you run for the hills, there are some significant advantages to having your investments managed by a Robo-advisor.

Accounts managed by Robo-advisors require less money to start and offer lower-cost investment products. With Wealthfront, you complete a brief questionnaire that determines your risk tolerance and goals, and then your portfolio is built for you.

In fact, all aspects of investment management are handled for you in a manner that suits the results of your risk tolerance assessment. This includes rebalancing, dividend reinvestments, and tax minimization.

Unlike Personal Capital, Wealthfront doesn’t offer personal finance software or budgeting tools. However, they do provide tools to help you achieve your aspired financial goals.

Investment Management

Let’s have a look at what both platforms offer in terms of managing your investment. After all, it’s what it’s all about, isn’t it?

Personal Capital

Personal Capital provides three different investment services based on the amount you have to invest:

- Investment Services: This is for investable assets up to $200,000.

- Wealth Management: For investable assets that range from $200,000 to $1 million

- Private Client: This is for investable assets that exceed $1 million.

Personal Capital customizes your investment strategy based on your personal goals and general financial situation. They will include medium-term investment goals that suit your current situation, such as buying a home or financing education.

They use a tactical weighting approach with the traditional indexing of U.S equities, which allows them to maintain a more evenly weighted exposure in sectors and stocks.

The portfolio they create for you is based on Modern Portfolio Theory (MPT). This will include a diverse sample of 90 to 120 separate stocks for both tax optimization and tactical weighing. That’s as well as a small-cap index Exchange-Traded Funds (ETF’s).

Your portfolio is rebalanced as necessary to keep asset classes within the allotted target and is also monitored daily.

Personal Capital uses six asset classes in your portfolio. These include:

- U.S stocks

- International stocks

- U.S bonds

- International bonds

- Cash, for liquidity

- Alternatives- such as “hard assets” like real estate investment trusts (REITs), energy, and gold, as hedges against inflation.

Investment Custodian

You’re not required to deposit your investment funds. But, instead, your account is held with Pershing Advisor Solutions alongside more than $1 trillion worth of their other clients’ assets.

You’re able to view your account through the Pershing online platform, which can be found on the Personal Capital dashboard. You will also periodically receive electronic statements from both Personal Capital and Pershing.

More Personal Capital Features

Here are some of the other features and benefits offered by Personal Capital:

Access to financial advisors- On the paid version, Personal Capital will give you access to financial advisors. If you have invested at least $200,000, you’ll have two allocated financial advisors.

Accounts- Individual and joint taxable accounts; traditional, Roth, rollover, and SEP IRAs; Trusts, and advice only employer-sponsored retirement plans and 529 college plans.

Minimum initial investment- No minimum for the free financial software, but a minimum of $100,000 for the investment management version.

Tax- Various strategies are used to try and minimize investment generated income taxes, such as tax allocation and tax-loss harvesting. They also use tax efficiency strategies, such as avoiding mutual funds, as they are more likely to generate capital gains.

SRI- SRI, or Socially Responsible Investing is something that Personal Capital has recently got involved with. This is where investments are made in more environmentally-conscious companies, helping society, or corporate governance. Though they invest in the same six asset classes listed above, they focus more on social responsibility.

They also avoid sectors such as adult entertainment, tobacco, military contract, gambling, etc.

Wealthfront

Let’s take a look at what Wealthfront has to offer investors. They provide service to new investors, but also provide enhanced investment options for larger investors.

Wealthfront also uses modern portfolio theory, and they tend to follow a passive investing strategy. Rather than trying to outperform underlying investment benchmarks, they will try matching them. This is done by investing your portfolio in low-case, index-based ETFs.

Wealthfront spread your portfolio across as many as 11 different asset classes. These include:

- U.S stocks

- Emerging market stocks

- Corporate bonds

- U.S government bonds

- Foreign developed market stocks

- Dividend growth stocks

- Real estate

- Natural resources

- U.S Treasury Inflation-Protected Securities (TIPS)

- Municipal Bonds (taxable accounts only)

The asset classes your portfolio is invested in depends on your risk tolerance and your goals.

More Wealthfront Features and Benefits

- Minimum initial investment- Wealthfront is more tailored for the beginner investor, and only requires a minimum initial investment of $500.

- PassivePlus- This is designed to increase returns without increasing risk. Wealthfront uses time-tested, rule-based strategies to invest beyond index funds.

- Accounts- Individual and joint taxable accounts; traditional, Roth and rollover and SEP IRAS; trusts and 529 college savings plans. They also provide automatic dividend reinvestment and periodic rebalancing on all accounts

- Tax Minimization- Tax-loss harvesting is offered on all accounts. They use index funds and dividend reinvesting to rebalance your portfolio, to minimize capital gains. They also utilize tax outcomes through tax location, holding income-generating assets mainly in tax-sheltered plans.

- Transfers- Rather than immediate liquidation to cash, transfers are done gradually to minimize tax implications. They recommend you sell incompatible investments, such as mutual funds, as this doesn’t coincide with Wealthfront’s investment methods.

- Risk Parity Fund- Wealthfront offers a mutual fund that’s available to account holders with balances boasting a minimum of $100,000. This is for taxable accounts only. The Risk Parity fund aims to increase your risk-adjusted returns, namely, through an enhanced asset allocation strategy based on a more significant number of markets.

- Smart Beta – Once you’ve invested a minimum of $500,000, this service won’t cost you a dime! The concept of Smart Beta is that it increases your returns by weighing individual securities more sharply.

- Socially Responsible Investing- Wealthfront offers a modified version of SRIs that differ from what’s provided by Personal Capital. If you qualify for either smart beta or stock-level tax-loss harvesting, you can let Wealthfront know which companies you don’t wish to invest in.

More Features

Still not sure which investment managing platform is suited for you. Let’s take a further look at the unique features that each platform has to offer.

Wealthfront

Wealthfront doesn’t offer budgeting tools like Personal Capital. However, they do provide tools and features you don’t get with Personal Capital…

Path

Wealthfront has a tool called Path. This helps you to plan and track all your major financial objectives for your life. For instance, college savings, buying a house, or your retirement plan.

- College Savings: Path analyzes how much college will cost, the financial aid available, and how much you will need to save and invest in this. You can choose between linking an existing plan from another sponsor or opening a new 529 college savings plan.

- Buying a home: Finding the right home is stressful. Finding the right home within your budget and having to factor in all the numerous costs is beyond stressful.

The path can help you find a home that is within your budget. The tool is combined with the online real estate platform, Redfin, to provide you with up-to-date prices.

It will also help you get a mortgage amount based on your net worth, credit score, debt-to-income ratio, and location. Furthermore, it factors in property taxes, insurance, maintenance, and even closing costs into your payments.

- Retirement plan: For many, retirement may seem like a long way off and something you don’t need to think about just yet. But the sooner you do, the better. The path can calculate your future retirement based on your circumstances and any changes to your situation. This could include promotions, a new addition to the family, deciding to retire early, or buying the home that Path helped you to find.

By linking your numerous financial accounts to Path, it will analyze your financial habits. Also, by using a team of Ph.D.’s to help forecast economic factors such as Social Security and inflation, they can give you an extensive view of your retirement situation. You’ll then be advised on how much to invest and which accounts will best achieve your goals. Very clever stuff!

Portfolio Credit

If you have an investment account balance of $100,000 or more, you can borrow against your Wealthfront investment account with no credit check, fee, or application.

You can borrow up to a quarter of your account balance and can do so at any time. It doesn’t matter what you intend on using the funds for, AND, and you can repay the loan on your own time.

Due to this being a secured line, interest rates currently range between 4.25% and 5.50% APR. This is comparable with home equity lines of credit.

Personal Capital

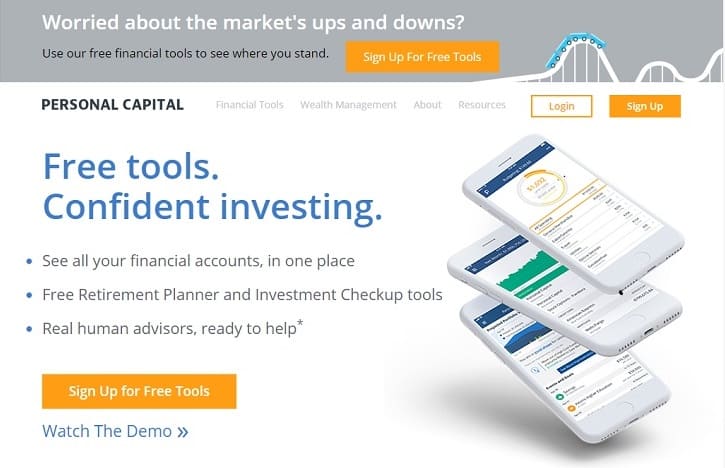

Unlike Wealthfront, Personal Capital does provide budgeting and investment applications. It is predominantly a wealth management service, which offers free financial software.

Personal Capital’s free version includes budgeting and goal settings. This incorporates strategies to help you achieve your financial goals. That’s as well as support managing your investments, retirement planning, and income and spending reports.

You can gather all your financial accounts on the Personal Capital platform. This includes bank accounts, retirement accounts, credit cards, investments, mortgages, and other loans. You can also track your net worth on this platform.

One of the downsides to this platform is that it doesn’t offer services like ‘Bill Pay.’ Nor can you bring together all your accounts and transactions.

Some of the exciting features Personal Capital offer include:

- Fee Analyzer: This helps you to identify hidden investment fees, and recommends alternative investments to reduce those fees.

- Investment Checkup: This tool analyzes your portfolio and offers advice on how to reach your goals and make improvements.

- Retirement Planner: This feature includes the Retirement Calculator. Similar to the way Wealthfront’s Path helps you plan for your retirement, this tool helps you to track your progress against your retirement goals. You can also calculate your Social Security benefits, pensions, and rental income.

The retirement planner can be used to help with other things unrelated to retirement — for instance, budgeting for college education or a down payment on a house.

Pricing

Let’s talk about money.

Personal Capital Pricing

As you’ve just read, Personal Capital offers financial software free of charge. This software includes not only budgeting tools but also investment support services.

The Wealth Management versions use a ranked advisory fee. For huge balances, it can be as low as 0.49% per year, though, for most investors, it will be 0.89%.

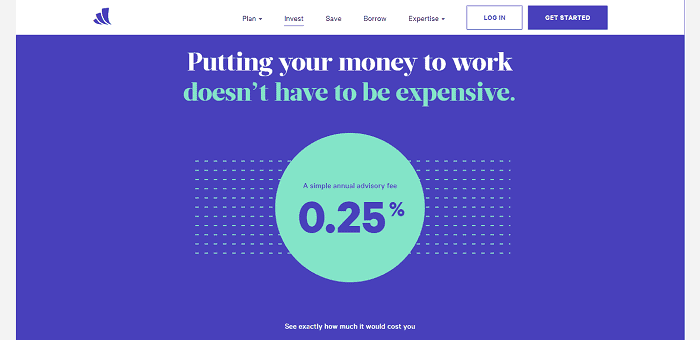

Wealthfront Pricing

Wealthfront charges a flat annual fee of 0.25%. This fee is lower than a lot of Robo-advisory platforms. Also, there are no additional fees, such as trading commissions.

Wealthfront informs that the expense ratio of the ETFs they use is 0.09% per year. This is a fee that is charged within the ETFs used and not a direct charge from Wealthfront to you.

Customer Service

Customer service is a “make or break” feature for many consumers. Both these investment managing platforms have high ratings online for their customer service.

Personal Capital can be contacted by phone or email 24 hours a day, seven days a week. Their website offers an FAQ page, and their free financial software provides a Support Portal that contains a lot of information.

Personal Capital can be accessed via desktop, tablet, and mobile devices. Their app is available on Android devices, Apple watches, and iOS gadgets, which you can download from either Google Play or the App Store.

Wealthfront can be contacted by either phone or email, Monday through Friday, from 7:00 AM to 5:00 PM, Pacific time. They also offer a help page and have a blog on their website that provides a lot of information.

Wealthfront is available on desktop, tablet, and Android and iOS mobile devices.

Frequently Asked Questions

Yes. Personal Capital is a cloud-based website that offers a 100% automated and comprehensive view of your overall financial picture.

Personal Capital headquarters are in Silicon Valley. However, they do have hubs in San Francisco, Denver, Dallas, and Atlanta.

Not particularly. Wealthfront is a Robo advisor platform that provides you with returns for a level of risk which you specified, agreed, and are willing to tolerate.

The Choice is Yours

Personal Capital is designed for larger investors who are looking for full-service investment management or budgeting tools. The fact that they offer lower fees than many other traditional investment managers is a welcome bonus.

Personal Capital offers comprehensive wealth management, free financial management software, and budgeting tools to manage your overall financial situation.

The downside to this company is that it isn’t for small investors. For a start, the account minimum is $100,000 and then adding to this, the annual advisory fee starts at 0.89%, which is well above what a small investor can get from a Robo-advisor like Wealthfront.

Wealthfront is one of the largest robot-advisors in the industry. They offer investment management at a meager fee, and are much more accessible for small, or beginner investors, with an account minimum of just $500.

The downside to this company is that it doesn’t come with tailored financial advice like you can get from Personal Capital. However, the focus of this platform is to be an automated investment service, not to offer personalized investment advice.

The choice is yours, and should only be made based on your investment amount, your goals, and what you hope to get from your investment managing platform.

What Do You Think?

We hope having read this review, you now have a better idea for whether Wealthfront or Personal Capital is the better solution for you.

Have you ever used either of these platforms? If you have, we’d love to hear your thoughts and opinions on the experience you had. Let’s kickstart the conversation in the comments box below. Speak soon!