- Stash vs Robinhood – Which is Best? - June 26, 2020

- Robinhood vs Fidelity Comparison - June 13, 2020

- Firstrade vs Robinhood: Which Option is The Best? - April 10, 2020

Investing is a risky business. It can get complicated quickly, and money can disappear like you are betting all your money on red at the roulette table.

With all of the market risk, why should more of your hard-earned money go to fees? Fees each time you make a trade, account maintenance, and even fees for not participating enough.

Today, I am going to compare two Robo investing sites that cut the fees to nearly nothing. We will weigh the pros and cons of M1 Finance and Robinhood. Plus, I’ll give you a few alternatives if you are still seeking the right place to invest your extra cash.

Main Differences Between M1 Finance vs Robinhood

The Main Differences Between M1 Finance vs Robinhood are:

- M1 Finance doesn’t offer cryptocurrency trading, whereas Robinhood supports cryptocurrency trading

- M1 Finance allows you to invest for free, whereas Robinhood charges $5 monthly subscription fee to invest on margin (Robinhood Gold)

- M1 Finance allows users can choose what companies they want to invest in and what percentage, whereas Robinhood doesn’t

What is M1 Finance?

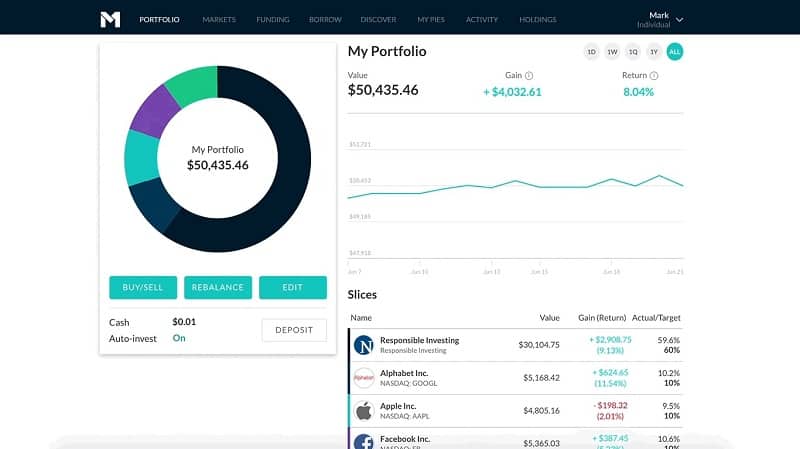

M1 Finance is the best of both worlds. It is a combination of self-managed funds and Robo-investing. If you want to be involved in your investments, but prefer not to pay trade or management fees, M1 Finance is for you.

Although investments are limited to stock and ETF, several investment categories, including socially responsible investing, retirement investing, and hedge fund-based investing, are available to build your portfolio.

You also have access to joint accounts, trusts, traditional and Roth IRA, SEP, and rollover IRAs. M1 Finance with automatically invest in new funds when your cash account balance reaches $10 or more.

Since M1 Finance doesn’t offer any support for outside investments, this platform is best for a new investor who is interested in taking investing seriously but doesn’t know where to start. M1 automatically balances your allocations every time you add more money. So, you can easily see what you are investing in and how these investments are performing.

M1 Borrow

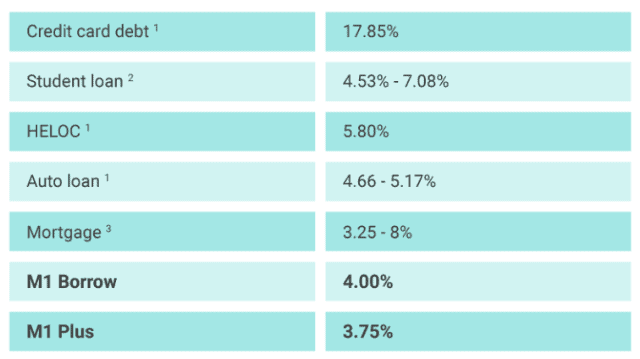

The M1 Finance allows you to borrow money from your portfolio at a historically low-interest rate of 4%. You can pay it back on your own time. However, to take advantage of this benefit, your brokerage account must have at least $10,000 in assets.

Coming Soon: M1 Spend

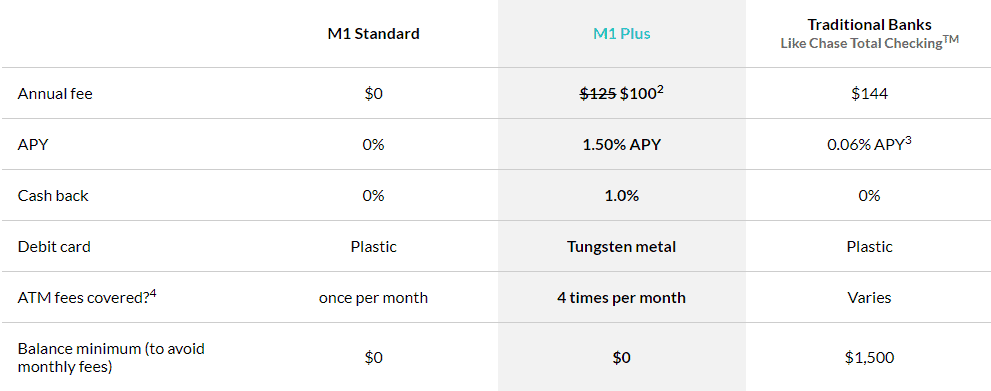

M1 Finance will offer M1 Spend that gives you access to a checking account within their investment app. It has all of the best features, including direct deposit, bill pay, and debit card access.

If you are interested in getting rewards from using a debit card (which is unusual for checking accounts that don’t require a minimum balance), you can upgrade to M1 Plus.

M1 Plus has an annual fee of $100, but a calculator on M1 Finance’s website will help you determine if it makes sense to have the account with your current financial situation.

History of M1 Finance

M1 was founded in 2015 by Brian Barnes. The company is headquartered in Chicago, IL and is a member of FINRA and SIPC, and registered with the SEC.

Barnes has been an investor since the fifth grade when he was given an investing project. Since becoming an adult, Barnes searched for a platform that would help him automate monthly deposits, maintain a consistent portfolio, and make profits easy to access.

Initially, M1 Finance charged a 0.25% fee to invest through its platform. However, in late 2017, the company did away with their fees to attract more investors.

The plan worked. Two months after eliminating the fees, M1 Finance doubled its user base, appealing to a younger market. Today, the platform has over 25,000 accounts and $100 million in assets.

What is Robinhood?

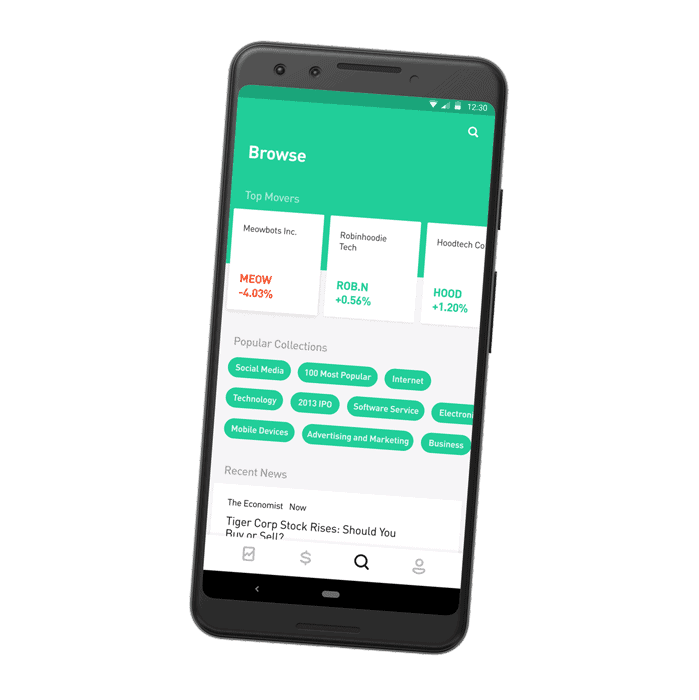

Robinhood is a mobile investing app that offers zero-fee trades on stock, options, ETF, and cryptocurrency. There is no investment minimum.

Robinhood Gold

For only $5 a month, you can upgrade your account to invest on margin. A $2,000 account minimum is required by Federal regulation and Robinhood Gold. A 30-day trial is available for new and existing users of Robinhood.

Investing on Margin

If you are a daredevil, you will love investing on margin with Robinhood. Investing on margin means you can borrow money directly from Robinhood to invest quicker without waiting for your own money to clear.

Robinhood sweetens the deal with the first $1,000 of margin trading included (at no interest). Any amount above the initial $1,000 has a 5% yearly interest (calculated daily, charged monthly). Robinhood even states that they will notify you of any change in subscription charge or increase in margin interest so you can have the change to opt-out.

This can get very sticky if the stock declines in value, in which you could owe more than you have in your brokerage account. Only invest on margin if you are a seasoned investor and know the risks.

Gold users get priority access to extended trading hours and can boost their buying power with larger instant deposits (i.e., If your portfolio value is over $50,000; you can instantly deposit $50,000).

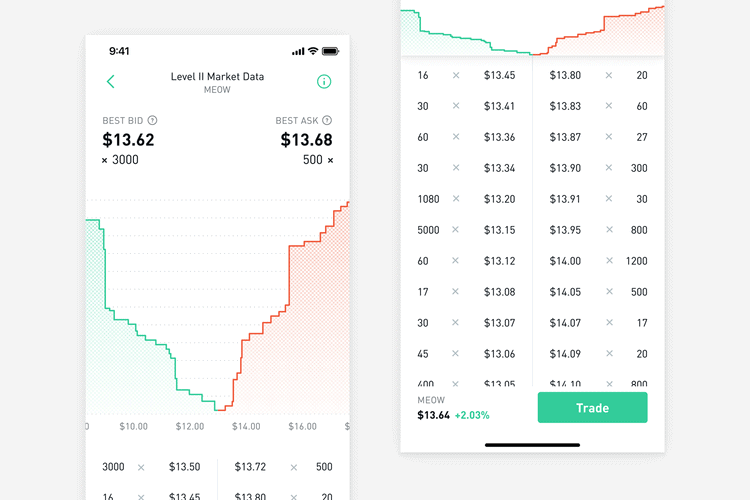

You will also be eligible for real-time investment stats from Morningstar (independent investment company) and market data from NASDAQ.

Robinhood Crypto

One of the biggest advantages of the Robinhood app is the ability to invest in crypto. This is a feature that its competitors have yet to copy.

You can invest in the following cryptocurrency options:

- Bitcoin

- Bitcoin Cash

- SV Bitcoin

- Dogecoin

- Ethereum

- Ethereum Classic

- Litecoin

Keep in mind that cryptocurrency is not an accepted form of investing via FINRA or SIPC. However, some investors see cryptocurrencies becoming more popular in the future. If you are interested in investing in crypto, Robinhood is a safe place to get started.

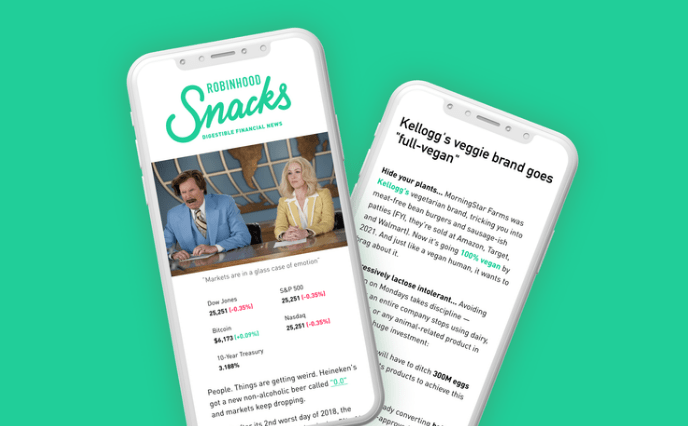

Robinhood Snacks

One of the cons of the Robinhood platform is that it has always lacked financial education. Robinhood recently acquired the popular media company MarketSnacks, a podcast and newsletter giving its followers top-rated daily financial news. Fortunately for its avid followers, the Co-Founders of MarketSnacks, Jack Kramer and Nick Martell, will continue to manage the content.

The content will now comprise of daily and weekly Robinhood Snacks financial trends newsletters, and a daily podcast called “Snacks Daily.” The content is free for everyone, regardless if you are a Robinhood customer or not.

Other content upgrades include improvements to market news inside the platform, discovery tools, and an expanded Help Center.

History of Robinhood

Robinhood was founded in 2013 by Co-Founders Vladimir Tenev and Baiju Bhatt. It is headquartered in California.

The firm is a FINRA-approved, registered with the SEC and a member of SIPC. The company makes money from interest on customers’ cash balances and margin loans.

Robinhood currently has over 6 million users and is valued at over $5 billion. The app aims to “democratize America’s financial system” by giving investors access to the everyday American that previously was only available to the wealthy.

Its no-fee approach has been a magnet for young investors. The app is aesthetically pleasing, easy to use, and continues to add features to make it an all-in-one Robo investing solution.

Features

The following features can be found on both the M1 Finance and Robinhood platforms.

- There are no trade or account management fees. This is the most appealing feature of M1 Finance and Robinhood. This is great for beginner investors who are starting their first investment portfolio.

- Choose from stocks or ETFs. Both platforms provide low-risk stocks and ETFs for the beginner investor. Additional options are available for advanced investors.

- You are investing on margin. M1 Finance provides this service for free with a $10,000 account balance. M1 Finance has a 4% APR and no restrictions on what the margin is used for. Robinhood requires a subscription to Robinhood Gold ($5 a month) and a $2,000 account balance. Robinhood has a 5% APR (first $1,000 is free), and margin trading must be used for investments within the Robinhood platform.

- Available for Android and iOS. M1 Finance and Robinhood are both available for mobile devices so you can check your investments on the go. Robinhood might have a bit of an edge in the UI department, though.

- U.S. only. Both companies only currently allow U.S. residents to join the platform. Upon signing up, you will need to provide basic financial information, including your social security number and bank account.

Investment Options

M1 Finance

- Choose from stocks, ETFs or professionally pre-selected portfolios

- Allows trading of a fractional share

- M1 Borrow (borrow up to 35% of your portfolio at 4% interest)

Robinhood

- Choose from stocks, ETFs, and options

- Ability to trade cryptocurrencies (bitcoin)

- Robinhood Gold, $5 monthly fee, invest on margin

What are the Fees?

Neither M1 Finance or Robinhood has any trade or account management fee. Both platforms are completely free to use.

Pros

M1 Finance

- No trade or account management fee

- Lowers your taxable income (built-in)

- Can set maximum cash balances, so money is always moving

- Users choose what companies they want to invest in and how much (i.e., 35%)

- Choose from stocks, ETFs or professionally pre-selected portfolios

- Allows trading of a fractional share

- Automatic portfolio rebalancing

- Liquid assets, money transfers are generally available in one day

- Web and mobile

- The M1 Borrow (borrow up to 35% of your portfolio at 4% interest)

- M1 Spend (checking account and debit card options)

Robinhood

- No charge for trading stocks, ETFs, and options

- Ability to trade cryptocurrencies (bitcoin)

- Web and mobile app

- Beautifully designed UI

Cons

M1 Finance

- Minimum investment of $100 (brokerage) and $500 (retirement account)

- No tax-loss harvesting

- No mutual fund investment options

- Doesn’t have outside investing support, such as employer 401(k)

- U.S. only trading platform

Robinhood

- You can only buy full shares

- Lack of investment educational tools

- Not available in all fifty states

- No tax-loss harvesting

- Doesn’t have portfolio rebalancing

- Integrations don’t always sync correctly

- No mutual fund investment options

- No investment categories like retirement, socially conscious, etc.

Why Should You Choose Robo Investing?

Choosing a Robo advisor is best for investors that are just starting and don’t have an investment portfolio or an employer 401(k). Most Robo investment platforms are free or charge minimal fees compared to human, financial advisors.

When you are spending less money on fees and trade costs, you have more money to invest. However, most Robo platforms only provide services, not financial planning. Most investors seek financial planning to help with big life events such as buying a home, going to college, or retirement.

Once you have established an investment portfolio and progress in your career, it is recommended that you pair Robo investing with a certified financial Robo advisor. They can monitor your investments, help you make changes when your portfolio is stagnant, and provide current industry knowledge when markets take a nosedive.

Alternatives

WiseBanyan

- No fees for trades or account management

- Only offers ETFs (with partial shares option)

- For a small monthly fee, you can add a tax protection plan that lowers your taxable income

Acorns

- $1 per month charge

- Works by investing the spare change from rounding up charges to the next dollar on credit or debit card

- Easily set up daily, weekly, or monthly debits

- Only offers ETFs

Wealthfront

- $500 minimum deposit

- 0.25% annual admin cost

- Path (offers planning for retirement, college, and purchasing a home)

- Tax-loss harvesting

- Portfolio rebalancing

- Wealthfront savings account

Betterment

- No minimum deposit

- 0.25% annual admin cost

- 401(k) assistance

- Tax-loss harvesting

- Portfolio rebalancing

- Financial expert help within the investment app

- Betterment Everyday (checking and savings

Frequently Asked Questions

Robinhood is very simple to use and might be the ideal choice for beginners. On the other side, if you are more advanced trader and you need more features, you can look the other way. What makes Robinhood good for beginners is that it’s easy to use, you can start pretty quickly, there is no commission on trades and you can open an account with very little money starting money.

Day trading means that you are buying with borrowed money and there is a risk of higher losses, however, it’s not illegal.

M1 Finance doesn’t have charges for any of the above-mentioned features. It’s a free trading platform is free for individual stock investors. However, they make their money by charging interest on the loans it offers to its account holders.

Yes. Keep in mind, however, that if you have a pending withdrawal request, you won’t be able to schedule another one until you receive the first initial. That may take up to a few business days.

Conclusion

Before you choose a Robo investing company or any investment company, you need to decide how much you want to participate in your investment strategy.

Are you the type of person that prefers to pick all of your stock trading options, or do you want everything to be preselected? Are you ready to be a long-term investor, or do you just want to dip your toes in the water?

You should also set a budget for the amount of money you want to invest in. Be careful that you don’t get addicted to stock trading and fail to put money in savings or pay your bills.

Investing should be a part of your daily goals, so at some point, you can retire and not have to work forty hours a week. Read over the terms of the investment platform you choose. Start small. You can always increase your investing or cash out if you’re not comfortable.

Further Research

- Citi Double Cash vs Chase Freedom Unlimited – Which is Best?: Citi Double Cash vs Chase Freedom Unlimited: Two of the most popular cashback credit cards. Read our detailed comparison to find which is right for you

- Principles of Investing: How to Invest Money Wisely: Everyone should know the main principles of investing. In this article, we give you the crucial information you need to consider before you stake your money