- Wells Fargo vs Bank of America: Which is the Better Bank? - November 9, 2019

- M1 Finance and Betterment: A Complete Comparison - November 4, 2019

- Personal Capital vs Wealthfront: Which Should You Go For? - October 20, 2019

M1 Finance and Betterment are both investment sites that help you choose your own investments. If you are time-short (and who isn’t these days?), but still want to make your money work for you, then considering a Robo-investment option may be the best way forward.

There are plenty of Robo-investment options out there, so it can be difficult to know which one, or which ones to go for first. Here we take a look at two popular choices: M1 Finance and Betterment. Both have similarities, and both have differences, so let’s take a quick look, followed by a more in-depth look at what each one offers. But first off, let’s see how they differ from each other:

Main Differences Between M1 Finance vs Betterment

The main differences between M1 Finance vs Betterment are:

- M1 Finance offers free automated investing with no commissions or account fees per service charges for mail statements and account closures, whereas Betterment takes an annual fee of 0.25% for accounts with balances of under $2,000,000 and 0.40% for balances of $2,000,000+

- M1 Finance lets you select your own investments, whereas Betterment seems to offer less in terms of investment choice for its customers

- M1 Finance minimum start amount is just $100 or $500 for retirement accounts, whereas Betterment has no minimum start amount

- M1 Finance has human advisors for phone support but not for portfolio investment advice, whereas Betterment has human advisors for phone support AND advice for portfolio investment

- M1 Finance has $100 million assets under management, whereas Betterment has $14 billion assets under management

- M1 Finance has no goal tracker, whereas Betterment has a goal tracker

- M1 Finance doesn’t 401k plans, whereas Betterment does

So, upon first glance, what are the pros and cons of each?

M1’s pros have to be that you can choose your own investments, there are no account fees, and you can select individual stocks to invest in. With Betterment, the pros are that there’s no minimum investment, Betterment will automatically invest extra funds, and there are many customized portfolios. Betterment also has humans to offer you investment support.

As for cons, well, the obvious ones are that M1 has no humans to talk to, and you can only trade once a day. Betterment charges pretty high fees for larger investors and has fewer investment options.

So, now the overview part is done, let’s take a more detailed look at each option so you can better decide for yourself which one to go for.

M1 Finance

They say that: “we believe you work hard for your money and do your money should work hard for you.” Brian Barnes, their CEO, and Founder goes on to say that: “To that end, we will continually dedicate ourselves to rethinking what is possible, using the latest technologies to create the next-generation financial institution. M1 will improve the options for how you can manage your money by building an entirely new set of financial products that will make it possible to do exactly what you want to with your personal finances with minimal effort.”

M1 started out in 2016 and now has 200,000 users and manages hundreds of millions of dollars.

Creating Your M1 Portfolio

Investors create pie charts, which is a visual way of designing your investment portfolios. Each slice of pie represents a bond, fund, or stock. Investors can create up to 500 individual assets or investment pies/portfolios. Each slice of the pie = a percentage of your portfolio. Looking at these pies is an easy way of looking at your investments.

If you’re new to investing, M1 can also offer you already-made or pre-designed investment pies to choose from before you get more confident as you go along and grow your portfolio. These pies include selections offered by other similar Robo-advisors. M1’s pre-designed investment pies are created according to a few categories, including:

- Hedge Fund followers (copies the investment strategies of reputable hedge funds)

- Plan for retirement (your portfolio goals will be adjusted as you get older)

- General investing based on your tolerance to risk

- Sectors and industries, so you can choose an industry you want to invest in

- Bonds and stocks

- Responsible investment, allowing you to be an ethical investor

For investors not sure where to start, M1 Finance also offers pre-made investment pies to choose from. If you’re unsure how that looks, then imagine, say, you want to invest 10% of your money in a tech company such as Samsung, then, your pie will show that 10% of it is taken up by Samsung.

You can set up an individual taxable investment account or a joint account with a relative, domestic partner, or spouse. You can also plan your retirement with SEP, Roth and Traditional IRAs. Last but not least, you can manage Trust investments with an M1 Trust Account.

Clients can customize their portfolio by choosing the funds and stocks they want and are offered a choice of more than 80 expert portfolios. You can also own stocks and ETFs, regardless of what the share price is, with fractional shares. It is possible to diversify your portfolio.

For the time-poor, you can automate your financial contributions with investing schedules. You can also keep an eye on your investments and ensure they are performing well, with what M1 calls “dynamic rebalancing.” It means you don’t have to place manual trades ever.

What this means, in reality, is that when you add money to your M1 account, M1 then automatically invests it in shares according to whatever percentage rates you have set beforehand. So, following on from our Samsung example, if you add $2,000 to your account, $200 will go to investing in Samsung.

You can take automated investing even further by giving M1 permission to withdraw monies from your account regularly, automatically.

If you’re worried about creating your pies and then you read something interesting on an investment blog and change your mind about your investments, you can change your mind. You can modify your finances and “remove” a piece of pie and add a new, different slice.

When you’re on your account screen, there’s an edit button you can use to “edit” your pie. There’s an “Add” button to add a different investment. M1 does all the adjusting/calculating, so you don’t have to do any figure work yourself aside from deciding what percentage you want to invest.

In a nutshell, there are five steps to get started:

- Create an account

- Create Pie

- Choose account type: Individual taxable, joint, IRAs, and Trust.

- Link a bank account to fund your M1 account

- Let M1 get on with it.

Borrowers

M1 Borrow allows customers to borrow up to 35% of your portfolio and payback on a schedule. The 35% refers to margin accounts with a minimum balance of $10,000. This option does not apply to retirement accounts.

A new home, a family event like a wedding, or a car, are all typical things you may borrow money to pay for. Borrowing may also be useful for consolidating any existing loans you have elsewhere. It’s a more straightforward way of keeping all your debts in one place, with one interest rate. As such, they’re much easier to manage. Common debts include student loans, personal loans, mortgages, and so on.

When you consider credit card interest rates are around 18% (or more), car finance is about 5%, and mortgage rates are approximately 3.97%; M1’s interest rates come in lower, at 3.75%. But, bear in mind this is subject to change and based on short term interest rates. If you’re on an M1 Plus account, then the interest rate drops to 3.5%, and you get a 0.25% discount on M1 Borrow.

Basically, their big USP is that there’s “no paperwork, no credit checks, no loan officers, and no denials.”

M1 Spend

This is billed as a “coming soon” option, where you can integrate your checking account directly into the M1 App. It’s an FDIC insured account and a way of M1 enticing its customers to use them, and only them for all your financial needs.

In a nutshell, you get a checking account with a debit card, you can transfer money and make direct deposits from other accounts you hold with M1. For M1 Plus customers, there are incentives such as cashback of 1% on debit card buys and a 1.5% APY (annual percentage yield). There’s no minimum balance required to open an account, and the same applies to obtain an APY. M1 Plus costs $125 a year, although it’s discounted down to $100 for the first year.

This all differs from traditional banks who offer little or no APY at all, charge a higher fee than the $125 and have a balance minimum to start with. The slight downer is that you get ATM fees, but these are reimbursed for M Plus customers four times a month and once a month if you’re on a standard account.

A Bit More About M1 Plus…

Are there really any advantages, or is this just another ploy to get you to part with money needlessly? We think it’s a good offer, for $100 initial layout, if you’re getting 1% cashback, you can recover that with higher outlays pretty quickly. There’s also the discount mentioned above for borrowing, and soon, customers will get access to a second trading window.

Access

Access is via a mobile app or via a laptop only. There’s no storefront, it’s strictly online only and works with Android and iOS equally.

M1 Finance: A Brief Summary

We think M1 is excellent for DIY investors, who can customize their investments and savings, and M1 does the management. However, customers don’t get advice or recommendations, and their website offers scant detailed information for anyone big on detail and small print and has the time and inclination to digest such information.

Given that M1 trades once a day, we think that it’s not really an App for day traders who want to keep on all day. Really, it’s more of a choice for longer-term investors.

Betterment

Betterment’s bigger, as is its portfolio, but is it better or just different?

Betterment says it is the “largest independent online investment advisor, and our mission is to help you make the most of your money. The more you deposit into any investment account, the longer we’ll waive your management fee.”

Many review sites say that Betterment is the better choice for absolute beginners. You can talk to a human, but everything investment-wise is automated, and there are fewer options, so if you’re a complete beginner, there is less room for error or miscalculation. It may feel less overwhelming.

Their website is divided up into three sections, which we’ll look at here: Cash, Invest, Retire.

We’ve already said that one of the main differences between the two software platforms is that Betterment charges fees. These are divided up into two tiers:

- The Digital Basic Service for balances up to $100,000, with a 0.25% annual fee. For this, you get tax-loss harvesting, access to real actual financial experts, automated portfolio management, and automatic rebalancing.

- The Premium Service is for balances over $100,000 with a 0.40% annual fee. For this, you get unlimited access to real actual financial experts who can advise on all your investments, not just the Betterment ones.

Both tiers give you a 0.2% discount on a Betterment balance of more than $2,000,000, but this does not apply to 401(k) investments. Any monies above $2,000,000 get the reduced fee.

In a nutshell, getting started with Betterment is done in a few simple steps. You tell them your age, annual pre-tax income, your investment goals such as retirement, college funds, emergency fund, etc.) and the types of accounts you want to open. If you go ahead, you’ll also need to naturally link your bank account with Betterment to facilitate any investments you go on to make.

Betterment will then look at the above information and suggest a portfolio for you, which is basically a set of recommended stocks and bonds for you to invest in. Any suggestions made are done according to your pre-assessed attitude towards risk.

Cash

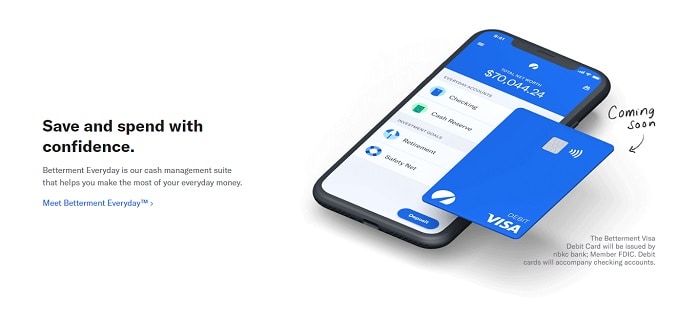

In the Betterment world, this is also known as Betterment Everyday™ or a cash management software program that you can use to start saving. There are two options available for customers to choose from Cash Reserve and soon, a Checking Account.

The Cash Reserve option is a high yield account where you can earn a variable interest rate of up to 2.04% APY. A minimum $10 deposit is needed, and the account is FDIC insured for up to $1,000,000. You can move your money in and out as much and as often as you like.

The soon to be checking account and debit card works a little like the M1 option. There’s no minimum balance, no fees, including no overdraft fees, and it’s FDIC insured up to $250,000. ATM withdrawal fees are reimbursed worldwide, and you can use your debit card anywhere that takes VISA.

Currently, there’s an option on the Betterment website to join the checking account waiting list.

Invest

Betterment says that its portfolio strategy is based upon “Nobel Prize-winning research,” although it’s not immediately visible on their website what that research is. No matter what they do state for all to read is that their investment portfolio strategy is a “globally diversified mix of exchange-traded funds, chosen to help you earn better returns at various levels of risk.

Bear in mind that Betterment only invests in Exchange Traded Funds (ETFs). These are basically a diversified collection of assets that include stocks, bonds, and commodities.

Customers are offered a range of stocks to invest in from around the world, including from emerging markets such as China, Taiwan, Russia, South Africa, Thailand, and India and developed markets. Their website shows a complete list of their stock ETFs. Customers also get to buy US investment-grade bonds, not just US Treasury bonds.

When you open an investment account, you get to choose your goals and, based on these, Betterment makes specific allocations based on the Betterment Portfolio Strategy.

Betterment takes a two-pronged approach to investments and recommends its customers follow a two-part process: fund selection and asset allocation. Betterment likes to divide up investments into ‘the developed markets’ and the ‘developing/emerging markets’ in the countries already referred to above.

In other words, US stocks are separated out, not least because they can be traded more cheaply.

Where bonds are concerned, these are separated into:

- US high-quality bonds

- US municipal bonds

- US high yield corporate bonds

- US inflation-protected bonds

- US short-term investment bonds

- US short-term treasury bonds

- International emerging market bonds

- International developed market bonds

If that’s a bit much for you as a novice or time-poor investor, there their site explains each of these options. Plus, you can always talk to an advisor if you’re unsure what to do. There are also articles written by their investment team managers, that layout the nuts and bolts of the arrangement. These are worth reading if you want the fine print on where your money’s going before you sign the dotted line.

If you’re wary of only going for a Betterment portfolio, Betterment investors can go for customized investment options too. The site now offers a socially responsible portfolio, a BlackRock Target Income Portfolio, which is designed for conservative investors who want some cashflow or a Goldman Sachs Smart Beta Portfolio for investors who don’t mind a bit of risk and fancy beating the market. These three new investment portfolios can be selected in addition to or instead of your traditional Betterment goal-based portfolio.

Retirement

Betterment says that “no two retirements are the same.” With this in mind, they offer their customers the option to create personalized plans for retirement and recommend accounts that will best help with retirement goals.

There are three kinds of account available:

- IRA (traditional and Roth)

- External 401(k) and 403(b)

- Taxable Accounts (Individual, Trust, and Joint)

Betterment claims it can make your money perform 38% more across three decades. There’s a projected spending tool that allows you to look at your spending during your retirement, allowing you to save to accommodate that. Like M1, customers can set up auto-generated deposits from your account into your retirement account, so you don’t have to think about it. Betterment suggests rolling over an old 401(k) into a Betterment IRA, saying that doing so “could mean 60% lower fees.”

Access

Access is via a free Betterment App that is compatible with iOS and Android. The App allows customers to check their balance, their investments, make deposits, send messages for customer support help, and monitor your goals and how close you are to reaching them.

Betterment: A Brief Summary

Betterment is an excellent choice for beginners because it allows them to be relatively passive about their involvement beyond assessing their risk level and choosing the types of accounts they need.

It’s also good because there are no financial minimums, and its approach to tax-loss harvesting will help you pay less tax and make the most of your assets.

FAQs

Yes. Investing online on well known platforms like M1 Finance and Betterment is considered safe. In fact, online brokerages use safe tools on their platforms so the investors can feel ultimate comfort when investing.

Yes, you can create an individual stock and fund it whenever you want with any amount of money you want to fund it with.

Unfortunately, unlike Betterment, M1 does not offer tax loss harvesting, however, they do have a tax minimization feature tool that helps users reduce the amount of taxes owed.

No. Betterment will allow you to withdraw your money from at any time, without fees or penalties for withdrawals or account closures.

Overall: Which Comes Out on Top?

Both Betterment and M1 are Robo-advisors for investors. It really depends on the type of investor and the type of person you are.

If you’re a novice, go for Betterment. If you aren’t a novice, it’s worth a punt too, especially since you get access to advisors. However, Betterment seems to offer less in terms of investment choice for its customers, whereas M1 customers can choose their own investments, and they have a greater choice of investments too. At Betterment, yes, you get advice, but you just fill out a questionnaire, transfer your funds, and off you go.

M1’s website offers less information than Betterment’s own offering, but Betterment’s fees can start to feel a bit steep, and a broker may end up being cheaper. M1 has no fees and, if you think you don’t need personal advice and can crack this nut yourself, then M1 may well be the software platform for you. Ultimately, you have to decide how much hands-on control you want with your investments, and what services you want.

If you enjoyed this article check out our guides on Top 8 Ways to Turn $500 into $1,000 and How to Invest Money Wisely.