- How to Check Wage Garnishment Balance - October 3, 2021

- Statement Balance vs Current Balance Explained - September 20, 2021

“If a parsley farmer is sued, can they garnish his wages?” ~ Author: George Carlin

Wage garnishment is a legal process that is triggered against you if you do not pay your bills. It is a last-ditch attempt by the creditors to collect their money from you after multiple failed attempts to contact you and have an agreed payment plan that actually comes to fruition.

Collectors sue you, then if they win, they get consent through the court to garnish your wages. If the Internal Revenue Service (IRS) or Canada Revenue Agency (CRA) are involved, then they do not need a court order.

Wage garnishment rules depend on the country you live in and may differ from state to state or by province.

The CRA will send you a letter called Requirement to Pay (RTP) notice of which you are required to pay accordingly. If you do not, then CRA will notify your employer to garnish your wages accordingly. The same goes for the IRS. They will notify you in writing and if ignored them, they will proceed with wage garnishment with your employer.

How to Check Your Wage Garnishment Balance?

There are several ways you can check your wage garnishment balance from outside sources and from your own personal tracking source.

A written garnishment document must be received from the court if you were sued and the creditor was granted permission to legally garnish your wages or the government if you are arrears for tax evasion, child support, alimony. The documentation states the amount of money that you are liable to pay for via wage garnishment with your employer against your paycheck

The written court-ordered document is issued to you, if 1) you were sued and the creditor won, or 2) a wage garnished document is mailed to you from the government.

In addition, this written document should stipulate what the garnishment is for, how much you owe, who you have to pay back, how it will be paid back, and when it will begin.

Your Pay Stub

Once garnishment begins, you can check your pay stub for starters. Monitor it each time you get paid to ensure the amount is correct and to make sure it stops the time you completed your obligation.

Sometimes employers will show garnishment year-to-date on the employer pay stub. However, if it overlaps with a new year, the balance for the new year may begin at zero. Therefore, keep an excellent record of your pay stubs and monitor how much garnishment you have paid.

Keep Track Of Your Wage Garnishment Yourself

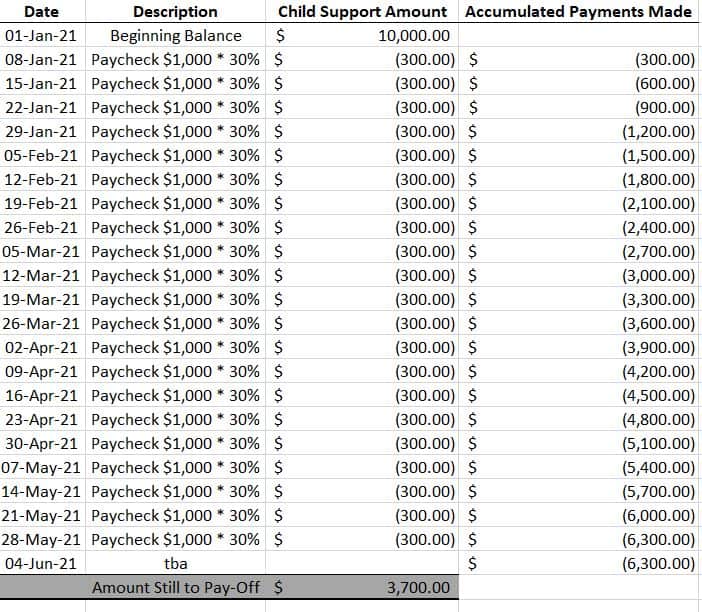

Use a simple spreadsheet to check your wage garnishment balance. Start with the beginning balance, then deduct the garnished amount upon each paycheck with a date so you can monitor when the debt is paid off and the garnishment ends.

Example: Say you are past due with a $10,000 child support payment. The court orders you to pay 30% of your pay.

You can start your spreadsheet with the debt you are ordered to pay. Then every paycheck wage garnishment takes $300 towards your debt. On your spreadsheet, you can record $300 against the $10,000 week after week. By the end of May, you can see that you put $6,300 towards the $10,000 and that you still owe a remaining balance of $3,700. If you continue on with your spreadsheet, you will notice that by Aug 27th, you have paid the full $10,000 child support and your wage garnishment should end.

Court Official Reports

Depending on your jurisdiction, creditors will provide an official statement of the account to date for both you and your employer. If it is not a jurisdiction requirement, you should contact them directly for a report on your latest garnished wage status. Check your wage garnishment balance on the statement vs your paycheck to be sure they reconcile.

Contact the Creditor that sued you

The creditor must have a paper trail that keeps track of what you owed, and how much you have paid to date. Therefore, you can contact them for a statement in your account. When you receive it, double-check the wage garnishment balance vs your paycheck and be sure they match.

TIP: Compare your documents. Take your pay stubs and compare them to the legal documents and or statements you received about your garnished wages to ensure they reconcile. Never take things at face value. If they don’t match, then contact your payroll department to help you clear the confusion up or the creditor. As long as you have the facts, which means a paper trail comprising your court order or government document and your paystubs, then all can be explained and reconciled accordingly.

Wage Garnishment Discrepancies

If the garnishment amount that is deducted from your pay stub differs from the written court order or governmental document, make sure you inform your payroll dept right away in order to get this sorted out. If this does not get resolved, then notify the business that sued you.

Wage Garnishment Paid Off

Once you have paid your debt off, then your wage garnishment should seize. The creditor will need to inform the court in order for the garnishment to be released.

Things to Know About Wage Garnishment

Court Order

Creditors for loans, credit cards, medical expenses must get a court order before they can legally have their wages garnished. Court orders are not required for money owed for child support, student loans, and back taxes and they must give you written notice before the garnishment begins. Check the laws in your State or Province to get specific on your rights. There are a small handful of states that do not let credit card companies garnish your wages. They are Texas, South Carolina, Pennsylvania, and North Carolina.

Your Pay Check

Your very own paycheck is usually affected by wage garnishment. The creditors will contact your employers and share this issue with them and in turn they make agreements with your employer to remove a set amount each payday and send that to them until the loan is paid off.

At this point, it is out of your hands. You are forced to pay them via your paycheck deductions. This can lead to embarrassment and distress when you find out that your money is being taken away without your consent. When it comes to this point, you do not have any say in this and must abide by the legal rules accordingly.

In Canada, depending on the province, the maximum wage garnishment is 50% of gross pay. As with, for example, a bank loan and credit card delinquent loans, the maximum is 20% for your pay.

Commercial debts (bank loans, credit cards, etc.) can only garnish a maximum of 20% of your wages. For governmental payments like child support, the garnish can go up to 50% of your pay.

Know exactly how much is supposed to be deducted from your paycheck and keep check your wage garnishment balance often.

Loan Recovery Alternatives

If you do not have a paycheck.. then there are other less attractive ways for a creditor to recoup their money from you. The less attractive ways is an invasion of your belongings with an asset value that when sold, the proceeds can go towards your debt. It is best to avoid going this route, for you and your family’s sake.

Alimony and Child Support Garnished Wages

In the USA, your wages can be garnished 50-60% to pay off alimony and child support debts. It depends on the rule of the state they are living in and your personal support status. Be sure to check the state or province you live in to see what the rules are so you protect yourself with the right information and can challenge anything that does not seem right or fair to you that may fall outside the law.

Garnished Wages for Student Loans

In the USA, your garnished wages can be around 15% if you have not paid back your student loan. If you are garnished for a past-due student loan, you have to be notified by the loaner and your employer must be given a 30-day notice.

In Canada, CRA will only make 1 attempt to give a verbal legal warning via phone, and then 1 written legal warning will be sent to you in the mail before resorting to wage garnishment. For students that are facing a wage garnishment from the government for student loans, the garnishment will equate to 30% of take-home pay and 100% of any funds held in your financial institute. Any funds they garnish from you will go towards your debt.

Past Due Taxes And Wage Garnishment

In the USA, IRS does not have to get a court order to garnish your wages. The amount they take from your pay depends on how many dependants you owe money for. In Canada, as with past-due student loans, CRA will only make 1 attempt to give a verbal legal warning via phone, and then 1 written legal warning will be sent to you in the mail before resorting to wage garnishment. They will issue a Requirement to Pay (RTP) notification to your employer, a third party which can be another individual (like a spouse or business partner), your financial institute, or other sources where you have funds.

Know Your Rights With Wage Garnishment

You have the right to stand up for yourself and plead your case if being sued.

You have the right to obtain a legal written garnishment document about the wage garnishment and details of the money owed, amounts deducted from your pay, and when the garnishment will end.

Dispute Discrepancies

Get your credit report to keep on top of your status

Your pay stub should show a breakdown of all deductions, including wage garnishment. In the USA, this will be a deduction against your net pay. Your net pay is also considered disposable income, which is your gross pay less than all payroll tax deductions. In Canada, your percentage of payment is based on your gross pay.

Don’t take it at face value, though. If the deductions are not clear, if they seem higher than expected, or if you feel you have already paid off your debts and the garnishment should have stopped, then contact your payroll department and if that does not work, try to settle the issue with the loaner.

Earnings That Can Be Subject to Wage Garnishment Are:

- Cash awards for attendance, safety, and service

- Bonus income

- Commission income

- Employment disability income

- Incentive income for moving or moving

- Insurance settlement income

- Merit increases that are retroactive

- Overtime income

- Pension and retirement program income

- Profit-sharing income

- Salary & wage income

- Severance and Termination income

- Worker’s compensation

Federal Income excluded from wage garnishment and bank account levies, unless you owe back taxes, federal student loans, and delinquent child support:

- Civil service benefits

- Federal student aid,

- Financial help from the Federal Emergency Management Agency (FEMA),

- Military annuities/ Survivor Benefits

- Railroad retirement benefits

- Service member pay

- Social security benefits

- Supplement security income benefits (SSI)

- Veteran’s benefits

Wage Garnishment and Being Sued

If you are being sued, then you may defend yourself in court to help lessen the impact on your wallet, your face financial hardship, or to dispute if you already made payments or any other legitimate form you see fit. You may want to get a lawyer involved to help you through the process should you be nervous handling this on your own. If you can handle it on your own, be prepared with facts, keep emotions under control. If you need help but may not be able to afford a lawyer, there are other lower-cost resources to go to like a free legal aid.

Pros of Wage Garnishment

- Your debts are being paid off, which can give you a feeling of relief

- If you are poor in money management, then you do not have to worry about paying your debt off as the creditor and your company will make the arrangements and handle the affairs accordingly

- Your debts will be paid off

Cons of Wage Garnishment

- You cannot control how much is garnished

- Your take-home pay is much less than expected

- Shame and embarrassment with your company’s management because they are now involved with your personal affairs

- You may lose your assets should they be garnished instead of your paycheck

Wage Garnishment FAQs

Answer: Wage garnishment happens when you refuse and ignore creditor’s requests to pay back the money they loaned to you. When money is loaned to you, you agree to pay it back. Within a specific time, period, or interest rates will apply. If you refuse to pay back the money, they will seek legal action and eventually get your employer involved. Once your employer is involved, then you will be notified that your wages will be garnished until the loaned money is paid off.

Note: A creditor cannot just threaten to garnish anyone’s wages without begging legally allowed to. You have rights and you have to protect yourself by standing up for them if you have the facts to support you.

Answer: No, actually there are different rules for each country, province, and state and therefore you need to contact your jurisdiction for further information on the rules and regulations that you must meet.

Answer: Yes, your credit score will negatively be affected because your delinquent debts will be notified by the creditor to the credit bureau.

Answer: No, your employer cannot legally fire you for your wage garnishment issues.

Answer: The following apply for either court order or direct governmental wage garnishments…

Alimony

Child support

Credit cards

Medical bills

Student loans

Taxes owed

Answer: You can avoid wage garnishment by responding to the creditors right away. Renegotiate payment terms and do whatever it takes to abide by their rules and expectations. If you ignore them, then the problem will get worse for you and soon you are legally forced to make payments you could not establish on your own which could hurt your pocketbook.

TIPS

If you find out that a creditor is chasing you for paying back your debts. Try to settle it out of court. Stop it before it continues. See if your creditor will renegotiate with you a new payment plan so you can settle your affairs with them directly and not with a court order.

If you move or change your phone number… Always keep your records up-to-date with your employer, bank, government agency, too. This will avoid ugly surprises should you have your wages garnished, for example, child support, and not know about it because you have been unreachable.

In Conclusion

Wage garnishment can be an upsetting and invasive process to go through because a creditor can take legal action against you and get payment from you through your paycheck or rights to sell your assets for proceeds. Even though you are initially in the wrong by not paying your debts, you can get some peace of mind that after you have paid back your debts, you are free to continue your life. The heavy burden that was on your shoulders can surpass, and hopefully, you have learned your lesson as to taking responsibility for your financial actions. Most importantly, you need to know that it did not have to get to this point. Even if you are scared because you don’t have the money, you need to know that creditors are willing to work with you as long as you don’t ignore them. Doing so will give you more of a peace of mind, still leaves you in control, preserve your privacy from your employer, and keep your credit score in better standing.

Further Read:

- Statement Balance vs Current Balance Explained

- Personal Capital vs YNAB: Which Tool is Best?

- Stash vs Robinhood – Which is Best?

References

USA: the U.S. Department of Labor- Employment Law Guide, Wages and Hours Worked: Wage Garnishment