- Stash vs Robinhood – Which is Best? - June 26, 2020

- Robinhood vs Fidelity Comparison - June 13, 2020

- Firstrade vs Robinhood: Which Option is The Best? - April 10, 2020

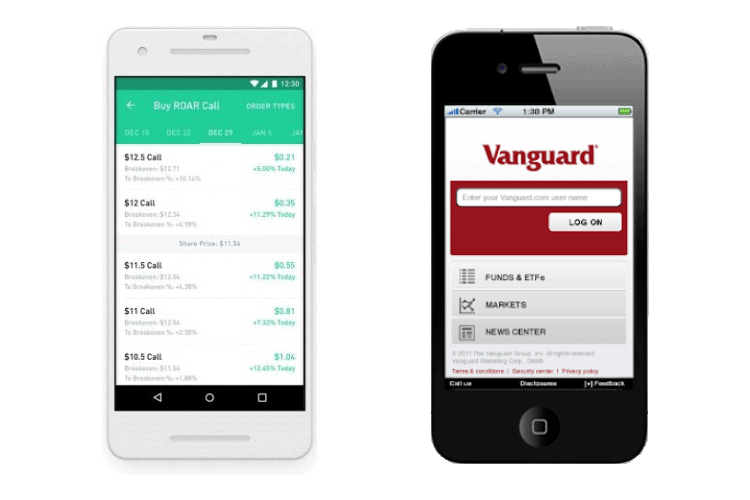

While Vanguard and Robinhood may seem like unlikely contenders, their client focus is appealing to millions of users. Vanguard features client-owned funds, helping you keep more money in your investment wallet. Robinhood allows investors access to the masses with its shiny mobile app, no account minimum, and fee-free trades from traditional stocks to trendy crypto.

Whether you gravitate toward the safety and security of traditional Vanguard funds or the thrill of investing in a startup, there isn’t a wrong choice. Both new and seasoned investors admittedly use both of these platforms for different reasons.

We compare and contrast the two brokerages to see which investment platform(s) is right for you.

The Main Differences Between Vanguard and Robinhood

The main differences between Vanguard and Robinhood are:

- Vanguard has retirement fund support (IRA, 401K rollover), whereas Robinhood does not

- Vanguard has human advisors can help give you advice, add funds, etc., whereas Robinhood does not

- Vanguard has college savings fund, whereas Robinhood does not.

- Vanguard does not provide promotions for new accounts or a referral program, whereas Robinhood gives away one stock and has a referral program

- Vanguard only offers full shares, whereas Robinhood offers fractional shares

- Vanguard is available nationwide, whereas Robinhood is not available in all states

- Vanguard does not have multiple forms of cryptocurrency trading, whereas Robinhood does.

What is Vanguard?

Vanguard offers no-fee trades on stocks, ETFs and Vanguard branded mutual funds. The minimum investment can vary depending on your fund choices. Vanguard provides its investors with knowledgeable human advisors and world-class fund options.

Vanguard has its own funds which are cheaper to trade and invest in than other market funds. The platform is designed for investors that have long-term goals such as retirement and want to invest in time-trusted funds. While short-term investing is possible, you are more likely to increase your assets by investing with them over a longer period.

Brief History

Vanguard was founded in 1975 under the direction of John C. Bogle. The company’s mission was to provide a large selection of mutual funds that were not governed by outside owners. Investors continue to jump on board to take advantage of Vanguard’s steady growth and lower fees.

As an established investment brokerage, Vanguard’s logo may seem outdated to those dabbling in the fintech space. However, the vintage ship logo icon is a symbol of the 19th-century vessel. Vanguard uses the phrase “in the forefront” and remains one of the largest global investment brokers to this day.

No Outside Owners

Vanguard has not had any outside owners from the start. This gives Vanguard an edge regarding stock pricing and how profits are distributed. Having client-owned funds keeps the cost low.

Currently, 30 million investors own the funds that own the company. Vanguard mutual fund and ETF fees are up to 83% less than the industry average.

Security

To access your account online, your browser must support at least Transport Layer Security (TLS) version 1.1. You will also receive a “green bar” reassurance when visiting vanguard.com. This extended validation is difficult to receive and is supported by a Secure Sockets Layer (SSL) certificate from Comodo. Both of these online security measures can provide privacy when accessing your account and help prevent attacks of fraud through certain browsers.

Additional security features include logon protection, time-out feature, account number masking, and extra verification.

Customer Support

Vanguard can be reached by phone (800 number) during business hours Monday through Friday (EST). For specific times, see below:

Retirement plan participants

800-523-1188

Monday–Friday 8:30 a.m. to 9 p.m., Eastern time

Institutional investors

800-523-1036 (plan sponsor or institutional consultant)

888-888-7064 (nonprofit organization)

Monday–Friday 8:30 a.m. to 9 p.m., Eastern time

Financial advisors

800-997-2798 (financial advisor, broker/dealer, or trust professional)

Monday–Friday 8:30 a.m. to 7 p.m., Eastern time

The Independent Adviser

Vanguard provides a monthly newsletter called The Independent Advisor that keeps you up to date on Vanguard funds and the company itself. If you love Vanguard branded funds you will appreciate the editor’s insight of over 100 Vanguard mutual funds.

Vanguard also publishes an annual guide “FFSA Independent Guide to the Vanguard Funds”. The printed edition is around $70 and is written for a more advanced audience that has a genuine interest in Vanguard funds.

If you are a Vanguard fan, you will appreciate the massive amount of data including a detailed account of each fund’s yield, minimum initial investment, fees, fund number, dividend frequency, and more. The annual guide also provides the last 10 years of data on each fund so you can better understand the fund’s stability and growth patterns.

What is Robinhood?

Changing the way we invest, Robinhood is responsible for so many established brokerages going fee-free. Easily trade fee-free from a convenient mobile app that is packed with stocks, options, ETFs, and cryptocurrency.

Anyone can open an account with no minimum. When you sign up, you will get one free stock from Robinhood’s inventory of settled shares. The share is valued at between $2.50 and $200 (randomly chosen).

Robinhood recently introduced fractional shares and is currently working on adding cash management (currently waitlist only). Upgrade to Robinhood Gold to reap the benefits of extended trading time, instant fund transfers, and investing on margin.

Brief History

Robinhood was founded in 2013 by Co-Founders Vladimir Tenev and Baiju Bhatt. As a California based company, it was the first to offer no-fee trades and tons of investors jumped at the chance to save on brokerage fees. Robinhood also made trading accessible to the masses by not having an account minimum and creating an easy to use mobile app for trading on the go.

With over 10 million users and a $7 billion valuation, Robinhood is quickly becoming one of the largest brokerages. Robinhood’s 2020 goals include expanding to the UK.

Robinhood is FINRA-approved, registered with the SEC and a member of SIPC. While there are no fees to trade, the company makes money from interest on customers’ cash balances and margin loans.

Robinhood Gold

There are three main benefits to joining the paid version of Robinhood. Robinhood Gold is currently $5 per month and adds the following features:

- Invest on margin ($2,000 account minimum (required by Federal regulation)

- Early and late trading (trade 30 minutes before the market opens and two hours after it closes)

- Instant ACH transfers or reinvestments. Get immediate access to your money so you can trade faster and more efficiently.

Robinhood Crypto

Robinhood is one of the few online brokerages to offer cryptocurrency as a trading option. You can currently add funds to your account or use assets from traditional trades to purchase crypto shares.

Robinhood Crypto is available in 46 states and Washington D.C. (as of 4th quarter 2019).

The following cryptocurrency options are available

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Dogecoin (DOGE)

- Bitcoin SV (BSV)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC

Use caution when investing in crypto. Cryptocurrency is not supported by FINRA or SIPC.

Security

Robinhood encrypts all of your sensitive information before storing it including your account password, social security number, etc. Banking credentials are only accessed when they are being verified. Banking information is not stored within Robinhood.

Bonus security features include mobile app access using TouchID, FaceID, or custom pin code. Plus, two-factor authentication via an external authenticator app or SMS.

Customer Support

You can contact Robinhood via phone and email, but the response time is not sufficient for a quick trade or general account issues. It is best to check their Support page (which can be accessed from the main website) if you have a frequently asked question

Investment brokerages such as E*TRADE, Ally Invest, and Fidelity all have 24/7 customer support.

Robinhood Snacks

Robinhood provides both a newsletter and a podcast. The newsletter, Robinhood Snacks, provides daily and weekly financial trends newsletters. The 3-minute e-mail newsletter will keep you updated on finance topics with a few good puns and a light-hearted meme to start things off.

They also produce a daily podcast called “Snacks Daily”. The podcast has over 10 million downloads. If you are pressed for time, you can get the 3-minute version, Snacks Minute, which consistently ranks in the top 10 podcasts on Spotify.

The newsletter is available for free via Robinhood’s website, while the podcast can be added to your Apple, Google, or Spotify accounts (accessible even if you are not a Robinhood user).

Shared Features

- $0 commission stocks, ETFs

- No physical branches

- No demo account

- Lacking in research tools

- Does not provide 24/7 customer service

- Used by both new and advanced investors

What are the Fees?

Robinhood and Vanguard have commission-free stocks and ETFs trading. Please see below for broker specific fees.

Vanguard

- $0 fee trading on stocks, ETFs, and thousands of no-transaction-fee Vanguard mutual funds

- $5 per month fee for 403(b) plans, charged to every user (does not increase as your assets grow)

- 0.30% annual fee of assets under management

- Minimum investment requirements: Invest in a Vanguard Target Retirement Fund or Vanguard STAR® Fund with as little as $1,000. The average Vanguard mutual fund requires a $3,000 investment.

Robinhood

- $0 trading fees for stocks, options, ETFs, crypto

- No inactivity or maintenance fees

- No account minimum

- $5 per month for trading on margin (Robinhood Gold subscription)

Pros

Vanguard

- One of the largest global brokerages

- Industry-leading mutual fund selection

- Lots of control for DIY investors

- Human advisors available

- Low fees on in-house (Vanguard) funds

Robinhood

- No account minimum

- $0 commission stocks, ETFs, and options

- Cryptocurrencies (Bitcoin) trade support

- Fast and reliable mobile app

Cons

Vanguard

- No trading platform

- Lacking educational investment tools

- Funds outside of Vanguard’s house funds have expensive fees

Robinhood

- Needs more financial education tools

- Not available in all states

- No mutual funds

- No IRAs

- Customer service is lacking

FAQ

Yes. You can invest in both SPY and VOO Vanguard ETFs on Robinhood. Both funds have similar performance. By investing in these ETFs on Robinhood you will avoid the $7-$10 per trade fee that can be imposed from other brokerages.

If you are looking to get your feet wet in the options market, Robinhood is a good start. Competitor brokerages have a few hundred ETF options without fees, Robinhood has over 2,000.

Beginner investors will appreciate the large selection of no-load mutual funds with low expense ratios. While there is a minimum deposit to invest in a mutual fund, Vanguard provides you with time-trusted funds from one of the largest brokerages in the world.

If you are just starting, the following funds do well on their own or in a trio: Vanguard Star Fund, Vanguard Target Retirement 2050, and Vanguard Wellesley Income.

Alternatives

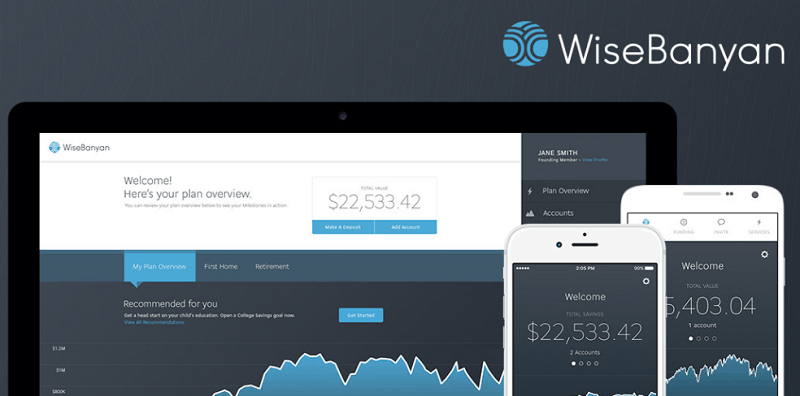

WiseBanyan

WiseBanyan is a Robo-investment platform that improves upon the standard investing app by giving each one of its client’s access to a finance expert. You can also start investing with only $1 and there is no minimum balance to maintain your account.

Similar to Betterment, you can build an ETF portfolio and make changes as needed. While fees for taxable accounts are non-existent, you will pay more for an IRA. Tax protection has recently been added to help protect your returns from taxes with products like Selective Trading, WiseHarvesting, and IRAs.

Pros:

- No hidden fees (annual fees for ETFs, investment fees for IRAs)

- Fractional shares

- Cash position (unique to WiseBanyan, it allocates cash as part of your overall assets)

Cons:

- Only one portfolio available based on your goal and risk profile

- No municipal bonds (high-income investors can’t take advantage of tax breaks)

- A premium package is required to invest in an IRA (not free)

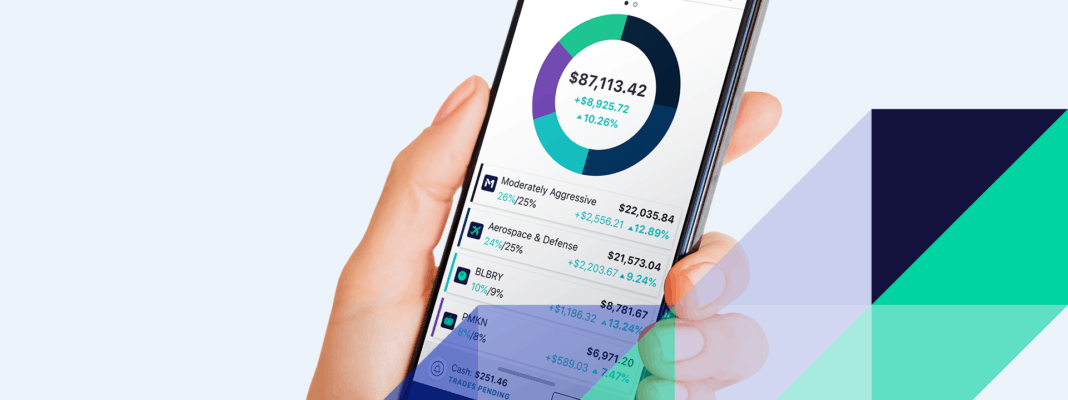

M1 Finance

M1 Finance is a low fee Robo-advisor that still gives you the control you crave. While you can select your favorite investments, you can also select pre-selected “pies” that help you reach your goals such as retirement savings. The platform also provides automatic rebalancing.

M1 Finance is unique in that you can choose from both stocks and ETFs to build your portfolio. Most Robo-investment companies only deal with ETFs. You can also create multiple investment portfolios if you have more than one savings goal.

Pros:

- Robo-investment “pies” are a mix of ETFs and stocks (Robo-investments are generally ETFs only

- Fractional shares

- Borrow against an account with low-interest rates

Cons:

- Doesn’t have mutual funds

- No securities trading

- No tax-loss harvesting

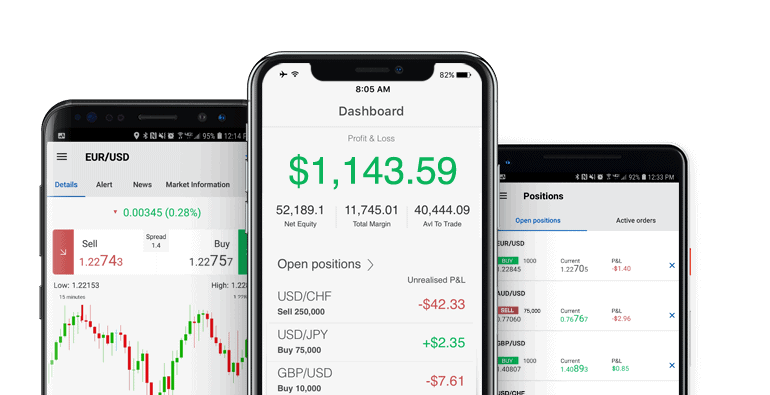

Ally Invest

If you are already a customer of Ally Bank, you will enjoy the seamless account integration signing up for Ally Invest. However, you do not need to be an Ally Bank customer to join Ally Invest.

Ally Invest offers a good variety of stock trading tools right on the dashboard. You can watch how multiple stocks perform before you take the investment leap. The platform offers stocks, mutual funds, ETFs, bonds, and options. It also has a strong mobile option and is easy to use for new investors.

Pros:

- Low fees

- Scalable from beginner to advanced

- Knowledgeable customer service (24/7)

- Managed portfolios option

Cons:

- No demo account

- No local branches

- High fees for managed portfolios

Established or Fintech?

With Vanguard’s account minimums, you will need to fork over some cash to get started. However, if you are interested in investing long-term or rolling over your 401K, Vanguard has proven it can provide you with gains. Vanguard also has access to foreign markets, research, and a larger portfolio of investment options compared with Robinhood.

Robinhood is best for young adults who are interested in starting to invest with a few bucks here and there. The platform is also great for active traders who want to save money on fees from trades they would pay a fee for elsewhere. Robinhood requires you to be an active investor. However, no financial advisors or 24/7 customer service is available if you need quick help.